Top-of-the-line methods to know what the “sensible cash” on Wall Road is considering is by combing by means of quarterly 13F filings. Giant hedge funds should file a 13F each quarter, disclosing which shares they’re shopping for, holding, and promoting.

Top-of-the-line cash managers of the previous 30 years has been David Tepper of Appaloosa Administration. Between 1993 and 2013, Tepper averaged a surprising 40% annualized return, and has had a roughly 23%-25% internet historic return from 1993 till immediately.

For sure, buyers could also be to know which shares Tepper likes in the intervening time. With an urge for food for each high-quality progress shares and bargain-priced worth shares, Tepper seems to have swapped one sort of inventory for the opposite within the first quarter 2024.

Trimming the Magnificent Seven for the “Magnificent Seven” of China

Tepper has clearly benefited from a wager on the substitute intelligence wave, with a lot of his prime holdings getting into 2024 in main Magnificent Seven shares or large-cap semiconductor shares, with each classes benefiting handsomely from the AI revolution sweeping over company America.

However within the first quarter, Tepper trimmed the overwhelming majority of those main U.S.-based know-how shares and reinvested the winnings into the Chinese language tech sector — primarily swapping out 5 U.S. Magnificent Seven shares for a basket of “Magnificent Seven-type” Chinese language tech shares.

Appaloosa’s new buys included 4 shares, Alibaba, PDD Holdings (previously Pinduoduo), Baidu, and JD.com, together with two China-focused exchange-traded funds (ETFs), the iShares China Giant-Cap ETF and the tech-focused KraneShares CSI China Web ETF.

|

Firm |

% Improve From Prior Quarter |

% of Appaloosa Portfolio Finish of Q1 2024 |

|---|---|---|

|

Alibaba (NYSE: BABA) |

158.6% |

12.05% |

|

PDD Holdings (NASDAQ: PDD) |

171% |

3.61% |

|

Baidu (NASDAQ: BIDU) |

188% |

2.81% |

|

iShares China Giant-Cap ETF (NYSEMKT: FXI) |

New |

2.27% |

|

JD.com (NASDAQ: JD) |

New |

1.48% |

|

KraneShares CSI China Web ETF (NYSEMKT: KWEB) |

New |

1.35% |

Knowledge supply: Whalewisdom.

As you may see, Tepper has made a extremely huge wager on Alibaba, making it his largest place at the moment. However the optimism possible extends to the broader Chinese language tech sector and actually all the nation’s economic system. Whereas there’s a huge wager on tech shares right here, the FXI ETF does include some state-owned and publicly owned banks as nicely in its prime 10 holdings.

Principally, Tepper and his staff could have concluded a long-awaited turnaround for the Chinese language economic system could also be at hand.

China’s economic system could also be choosing up

China’s economic system has actually been in a downturn since COVID-19, because the nation would not use U.S. vaccines and due to this fact tried to lock down the nation each time there was a brand new outbreak, disrupting enterprise. Moreover, the federal government determined to carry the regulatory hammer down on the nation’s main know-how corporations, limiting their progress and sometimes suggesting or mandating breakups and asset divestitures. Moreover, China pricked its actual property bubble, inflicting many massive property builders to go bankrupt, leaving many pre-paid housing initiatives unfinished.

However within the final yr or so, the federal government appears to have accomplished an about-face, easing the regulatory burden on know-how corporations whereas trying to stimulate its economic system and encourage progress. The consequence has been six straight months of constructive progress in China’s manufacturing sector, as proven by the Caixin/S&P International manufacturing PMI. And maybe most significantly, Chinese language officers have not too long ago contemplated shopping for unfinished housing initiatives from bankrupt builders and turning them into inexpensive housing or rental properties. Therapeutic the property sector can be a key to stabilizing the Chinese language economic system.

China’s tech giants are extraordinarily low cost

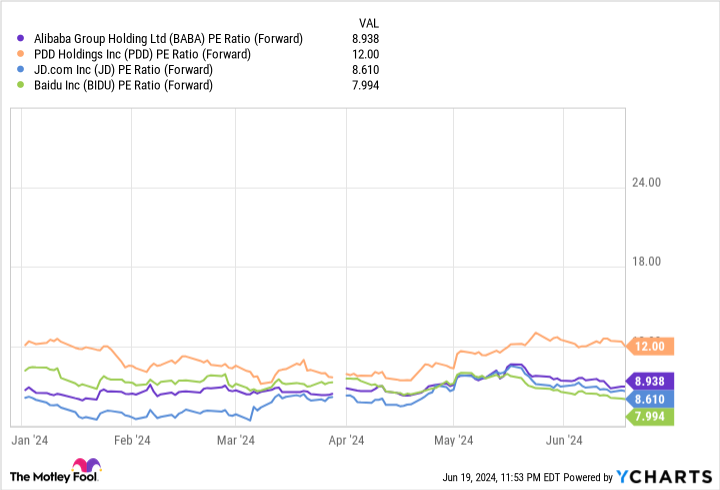

It seems Tepper’s staff could have anticipated progress choosing up within the nation, or that AI could assist China’s tech giants as they’ve U.S. tech shares. In the meantime, China’s main tech shares have fallen to absolute bargain-basement valuations, particularly in contrast with high-flying U.S. tech shares. PDD Holdings now trades at simply 12 occasions earnings, whereas Alibaba, JD, and Baidu every commerce between 8 and 9 occasions this yr’s earnings estimates.

In mild of a budget valuations and progress choosing up, most Chinese language tech corporations have been streamlining prices and launching massive share repurchase packages. Alibaba raised its buyback authorization by $25 billion within the first quarter and repurchased $4.8 billion price of its inventory in Q1, reducing its share depend by 2.6% in only one quarter alone. JD.com repurchased $1.2 billion, or 2.8% of its shares, within the first quarter, earlier than authorizing one other $3 billion program. And Baidu licensed a $5 billion share repurchase program in February, shopping for again $898 billion of its inventory this yr as of its first-quarter earnings report.

Thus, it is maybe not stunning to see Tepper trim a few of his U.S. AI winners whereas rebalancing into less expensive Chinese language tech shares shopping for again their inventory, particularly if he and his analysts additionally imagine the Chinese language economic system will proceed to get well.

Do you have to make investments $1,000 in Alibaba Group proper now?

Before you purchase inventory in Alibaba Group, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Alibaba Group wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $801,365!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Billy Duberstein and/or his purchasers don’t have any place in any of the shares talked about. The Motley Idiot has positions in and recommends Baidu and JD.com. The Motley Idiot recommends Alibaba Group. The Motley Idiot has a disclosure coverage.

Billionaire David Tepper Goes Cut price Searching: 6 Shares He Simply Purchased was initially printed by The Motley Idiot