The synthetic intelligence revolution has induced a development surge for the expertise’s enablers, most of which reside within the semiconductor sector.

Actually, the inventory actions for these firms have been so sturdy that many now commerce at very, very excessive inventory costs, setting these AI beneficiaries up for a possible inventory cut up.

Inventory splits do not create or destroy any worth on their very own. In any case, if an organization has twice as many shares however half the inventory value, the corporate’s complete market cap stays the identical. Nevertheless, inventory splits may also help sure individuals afford shares if they do not have a dealer that enables fractional share shopping for. Furthermore, splits can enhance a inventory’s liquidity, which may also help lower-bid-ask spreads for buying and selling functions, and subsequently entice bigger funds to a inventory.

Due to this fact, regardless that the next 5 shares have already had very sturdy runs, a cut up may doubtlessly drive these AI winners to even additional upside.

1. Nvidia

First and most evident on the listing is AI GPU chief Nvidia (NASDAQ: NVDA). Not solely is Nvidia presently main your complete AI revolution with its best-in-class AI chips and software program ecosystem, nevertheless it additionally has a historical past of inventory splits. Whereas Nvidia cut up its inventory a couple of instances within the early 2000s, its most up-to-date was a 4-for-1 cut up in July 2021.

In fact, with the inventory having quintupled since that cut up a mere three years in the past and its share value reaching $944 as of this writing, it isn’t a stretch to the suppose the corporate could select to separate its inventory once more.

Nvidia anticipated the AI revolution properly earlier than different friends did, giving it a protracted multi-year lead. Actually, Nvidia has been investing in its CUDA software program ecosystem since 2006. CUDA permits builders to program Nvidia’s graphics processors for information processing, thus enabling AI. Quick ahead to the introduction of ChatGPT in late 2022, and that foresight seems to be like a stroke of genius. The 17-year head-start on the competitors has allowed for some good community results, with AI builders constructing most of their functions with CUDA and making it troublesome for rivals to make inroads.

However Nvidia is not resting on its laurels; final October, administration declared it will double the pace at which it introduces a brand new chip structure, from as soon as each two years to as soon as per yr. On that be aware, administration launched its new Blackwell structure in March, which will probably be hitting the market in late 2024. These new AI chips supply a giant leap ahead over even the present Hopper structure, providing 2.5 instances the coaching efficiency and as much as 5 instances the inference efficiency over its predecessor.

Nvidia has its Q1 earnings launch tomorrow on Wednesday, Might 22, and all indicators level to its sturdy AI-fueled hypergrowth persevering with.

2. Tremendous Micro Laptop

One AI inventory that has had even higher returns than Nvidia over the previous three years is Tremendous Micro Laptop (NASDAQ: SMCI). Certain, lots of Tremendous Micro’s current success is owed to Nvidia’s AI chips, however SMCI’s returns within the inventory market have truly been far superior. Since July 2021, the final time Nvidia cut up its inventory, Nvidia is up by 5 instances. However Tremendous Micro’s inventory has elevated a whopping 25 instances over in lower than three years. Because of this, Tremendous Micro’s inventory value has appreciated to about $900 per share as of this writing, setting it up for a possible cut up.

A great a part of that outperformance was a results of Tremendous Micro’s ranging from a considerably decrease valuation. Up to now, its server merchandise had been considered “commoditized” with lots of different rivals within the house.

However the AI revolution has uncovered the enterprise mannequin strengths CEO Charles Liang had been cultivating for 30 years. Architecting its servers out of, “constructing blocks,” or creating the smallest attainable modules or server parts independently, then having the ability to construct servers out of any mixture of those parts, Tremendous Micro has mass-customization capabilities that allow it to fulfill just about any buyer modification request. Not solely that, however the structure additionally saves on prices, as components of a server might be refreshed as an alternative of getting to exchange a whole system.

Furthermore, Liang has careworn energy-efficiency in its server design for some 20 years, far earlier than it was trendy. However with the big electrical energy wants and prices of AI servers, Tremendous Micro’s environment friendly designs are discovering much more favor at present. And with places of work proper within the coronary heart of Silicon Valley near Nvidia and different chipmakers, Tremendous Micro is usually in a position to keep forward of rivals with the most recent in-demand options resembling liquid cooling, and is usually first-to-market with servers containing the most recent and best chips.

Whereas Tremendous Micro’s P/E ratio has ballooned from the only digits to 50 over simply the previous few years, it is also displaying the expansion to again it up, with a surprising 200% development final quarter. As such, I might anticipate Tremendous Micro’s share value to not less than keep these valuation ranges, with a inventory cut up doubtlessly within the playing cards.

3. Broadcom

One other AI beneficiary is Broadcom (NASDAQ: AVGO), thanks to 2 most important components. First, Broadcom makes the world’s main networking and routing chips with its Tomahawk and Jericho manufacturers, and information heart networking wants are exploding because of the data-intensive nature of AI.

Second, Broadcom has application-specific built-in chip (ASIC) design IP that third events can use to make AI accelerators. On this space, Broadcom has landed some huge fish, with each Alphabet and Meta Platforms utilizing the corporate’s ASICs to design their very own in-house AI accelerators.

Because of its extremely cash-generative enterprise and AI-fueled development, Broadcom has seen its share value rally to over $1,400 per share. That positively places it within the working for a stock-split.

In fact, the AI increase has solely been the newest catalyst pushing Broadcom’s inventory. Even earlier than the AI revolution, Broadcom was a formidable winner because of CEO Hock Tan’s visionary acquisition technique. Over the previous 18 years below his tenure, Tan has sought to amass sturdy semiconductor franchises, then reducing prices as these defensible area of interest applied sciences are folded into the Broadcom company umbrella.

Then in 2018, Tan expanded Broadcom’s attain when it purchased its first software program firm, California Applied sciences, diversifying the chipmaker into software program, albeit nonetheless inside its most important enterprise infrastructure market. After shopping for cybersecurity agency Symantec in 2019, Broadcom made its greatest buy but in VMware, a software program chief that permits hybrid cloud capabilities and information heart virtualization. VMware must also profit from the expansion of AI as prospects use many clouds with distinctive capabilities whereas striving to maintain their information secure in their very own information facilities. Because of the VMware acquisition, which closed late final yr, Broadcom’s software program combine has grown to roughly 40% of revenues.

Now, Broadcom is not only a chipmaker, however a diversified expertise platform firm with some ways to win. Search for its worthwhile development to stay sturdy within the years forward.

4. ASML Holdings

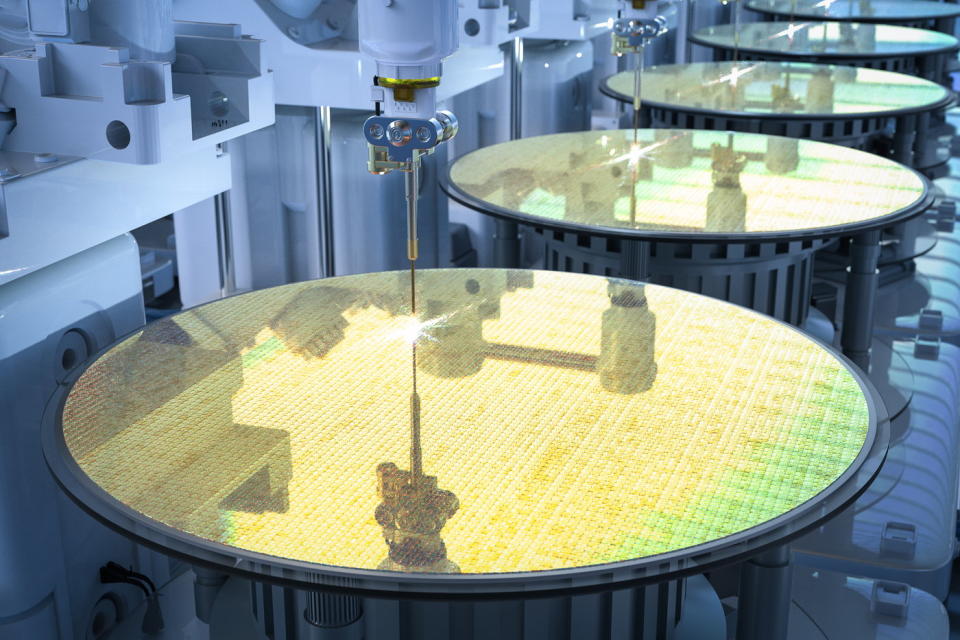

The trail to creating each modern semiconductor, Nvidia GPUs included, runs via ASML Holdings (NASDAQ: ASML). It’s because the Netherlands-based lithography firm has a monopoly on key excessive ultraviolet lithography (EUV) expertise wanted to make at present’s most superior chips.

EUV expertise took some 20 years to develop with important buy-in from ASML’s prospects to fund main analysis, so do not suppose that EUV capabilities might be copied anytime quickly. The ensuing expertise permits for chipmakers to attract extraordinarily high quality transistor designs with mild wavelengths that don’t happen naturally on earth. And ASML’s newest model of EUV, known as “high-NA” EUV, can print designs right down to widths of simply 8nm. ASML is about to rake within the dough from high-NA, simply launched late final yr, as these machines presently go for between $300 million and $400 million a pop!

EUV solely started for use commercially in 2018, with the primary EUV-enabled merchandise popping out in 2019. So, we’re nonetheless solely at first of the EUV period. As such, ASML has seen its inventory rocket 367% over the previous 5 years, reaching $940 per share, thus making it a candidate for a inventory cut up.

5. Lam Analysis

Like ASML, Lam Analysis (NASDAQ: LRCX) is a semiconductor gear chief that has additionally seen shares rally over the semiconductor bull market. However whereas ASML is the de facto chief in lithography, which attracts designs on a silicon wafer utilizing extraordinarily high quality mild, Lam’s expertise does the exacting and painstaking work of etching the printed design after which depositing semiconductor materials in extraordinarily intricate patterns to assemble the chip.

Whereas Lam would not have a transparent monopoly over etch and deposition expertise like ASML does with EUV, Lam truly does have a monopoly over sure course of steps within the chipmaking course of. Extra particularly, Lam dominates the deposition expertise essential to “stacking” chip parts in a vertical style. Over the previous decade or so, that has led to Lam benefiting from the manufacturing of 3D NAND flash chips, wherein memory-makers stack storage modules in a “3D” style in larger and larger numbers of layers with each technology.

Now, logic and DRAM chips essential for AI are additionally “going vertical,” together with high-bandwidth reminiscence DRAM that’s presently seeing such sturdy demand from AI functions. Actually, on its January convention name with analysts, Lam administration famous it had a 100% market share in sure applied sciences wanted for stacking DRAM modules. And with new gate-all-around transistors and 3D designs making their means into logic chips, search for Lam to get an extra AI increase within the years forward.

That is why shares have rocketed 385% over the previous 5 years to $941 per share as of this writing, setting this sturdy compounder up for a attainable inventory cut up as properly.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $566,624!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 13, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Billy Duberstein has positions in ASML, Alphabet, Broadcom, Lam Analysis, Meta Platforms, and Tremendous Micro Laptop and has the next choices: quick January 2025 $1,840 calls on Tremendous Micro Laptop, quick January 2025 $110 places on Tremendous Micro Laptop, quick January 2025 $125 places on Tremendous Micro Laptop, quick January 2025 $130 places on Tremendous Micro Laptop, quick January 2025 $280 calls on Tremendous Micro Laptop, and quick January 2025 $85 places on Tremendous Micro Laptop. His purchasers could personal shares of the businesses menitoned. The Motley Idiot has positions in and recommends ASML, Alphabet, Lam Analysis, Meta Platforms, and Nvidia. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.

Inventory-Cut up Watch: 5 Synthetic Intelligence (AI) Shares That Look Able to Cut up was initially printed by The Motley Idiot