(Bloomberg) — Earnings season is in full swing, with Massive Oil companies Exxon Mobil Corp., Chevron Corp. and TotalEnergies SE set to put up first-quarter outcomes later this week. Heavy-machinery maker Caterpillar Inc. additionally stories earnings that might make clear the power of the mining and building industries.

Most Learn from Bloomberg

Listed here are 5 notable charts to contemplate in world commodity markets because the week will get underway.

Oil

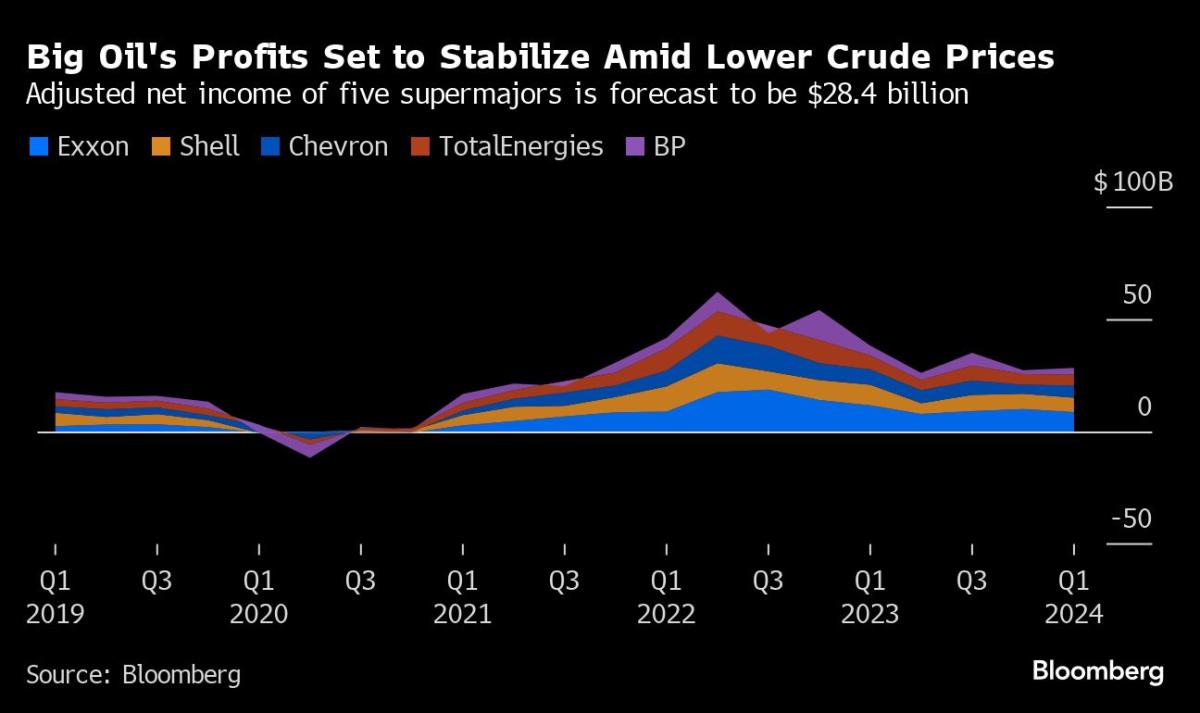

Massive Oil’s manufacturing development shall be within the highlight this quarter, as earnings stabilize and shareholders search for the trade’s subsequent lever to spice up money returns. Adjusted internet revenue for the 5 supermajors mixed is predicted to be $28.4 billion for the primary quarter, much like the prior interval as greater refining margins offset decrease oil costs and earnings from gasoline buying and selling. Exxon, Chevron and Europe’s TotalEnergies report outcomes Friday, adopted by Shell Plc and BP Plc in early Might.

Silver

Silver has had a powerful begin this yr, rising greater than 20% because the white metallic follows gold’s rally. Silver’s value has approached ranges not seen since retail merchants squeezed the market in early 2021 and is inside hanging distance of $30 an oz. File industrial utilization, particularly from inexperienced economic system purposes similar to photo voltaic panels, and an ongoing provide deficit ought to underpin costs going ahead, based on the Silver Institute. Which will immediate buyers to meaningfully return to silver-backed exchange-traded funds, serving to push costs even greater.

Corn

Regardless of all of the speak about demand for US corn after 2023’s report harvest, all eyes are on the dimensions of the Brazilian crop that’s virtually able to be gathered. Whole provide popping out of the world’s largest exporter will straight impression American competitiveness. Whereas the dimensions of Brazilian crop is up for debate — the US Division of Agriculture tasks a a lot larger harvest than Brazil’s Nationwide Provide Firm, generally known as Conab — a strong reaping may assist the South American nation maintain its rating as high exporter of the grain.

LNG

Europe’s demand for liquefied pure gasoline, which soared throughout the power disaster, will possible peak this yr, based on ACER, the bloc’s power regulator. The message shall be a reassuring one for European Union leaders, who had been left scrambling to search out gasoline after Russia, the area’s largest provider, invaded Ukraine. It additionally signifies that the US choice to halt new LNG export tasks received’t be as keenly felt as many feared. Now the EU simply must work out the way to cease the final remaining pockets of Russian imports of the liquefied gasoline. The European bloc is the most important importer of LNG.

Mining and Development

Caterpillar, whose iconic yellow machines are discovered at mining operations and building websites all over the world, is scheduled to report earnings on Thursday. Traders shall be looking ahead to particulars on orders and inventories from the US bellwether, with metrics that provide insights on the well being of industries underpinning the worldwide economic system. Of key curiosity shall be how Caterpillar’s vendor gross sales fare in a cyclical market the place demand and financial development is moderating, and whether or not North America’s gross sales power continues to offset weak spot in different areas.

–With help from Doug Alexander and Kevin Crowley.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.