Earnings season is formally right here. As per traditional, there have already been epic sell-offs and run-ups throughout well-known names.

Nonetheless, long-term buyers know that one of the simplest ways to view a quarterly earnings report is throughout the context of an funding thesis quite than the market’s knee-jerk response to short-term outcomes. That is precisely how these Motley Idiot contributors focus on Microsoft (NASDAQ: MSFT), Pfizer (NYSE: PFE), NextEra Vitality (NYSE: NEE), Dwelling Depot (NYSE: HD), and Fiverr Worldwide (NYSE: FVRR). This is why all 5 corporations which have what it takes to be strong long-term investments and are price shopping for in Might.

Microsoft exhibits no indicators of slowing down

Daniel Foelber (Microsoft): Microsoft continues to realize impeccable monetary outcomes. Whereas synthetic intelligence is a key driver of its progress, the sustained enlargement of its cloud enterprise has taken the corporate’s outcomes to new heights.

Finally, it would not matter which phase contributes probably the most progress so long as the general efficiency improves. Nonetheless, Microsoft continues to develop gross sales and margins throughout its segments. This one-two punch is a dream come true for buyers as a result of it exhibits Microsoft is turning into much more of a money cow by producing extra working earnings from every greenback in gross sales.

Within the latest quarter, Microsoft grew its Clever Cloud income by 21% yr over yr and boosted the phase working margin to 46.8% — which is extremely environment friendly. This is a have a look at how every of the corporate’s three segments is doing.

|

Metric |

Q3 Fiscal 2023 |

Q3 Fiscal 2024 |

Change |

|---|---|---|---|

|

Productiveness and Enterprise Processes Income |

$17.52 billion |

$19.57 billion |

11.7% |

|

Productiveness and Enterprise Processes Working Earnings |

$8.64 billion |

$10.14 billion |

17.4% |

|

Productiveness and Enterprise Processes Working Margin |

49.3% |

51.8% |

25 foundation factors |

|

Clever Cloud Income |

$22.08 billion |

$26.71 billion |

21% |

|

Clever Cloud Working Earnings |

$9.48 billion |

$12.51 billion |

32% |

|

Clever Cloud Working Margin |

42.9% |

46.8% |

39 foundation factors |

|

Extra Private Computing Income |

$13.26 billion |

$15.58 billion |

17.5% |

|

Extra Private Computing Working Earnings |

$4.24 billion |

$4.93 billion |

16.3% |

|

Extra Private Computing Working Margin |

32% |

31.6% |

(4 foundation factors) |

Information supply: Microsoft.

Microsoft’s high-margin operations give it loads of extra money to reinvest within the enterprise, make acquisitions, take dangers, and enhance its capital return program. Within the latest quarter, it repurchased $4.21 billion in widespread inventory and paid $5.57 billion in dividends, in comparison with $4 billion in buybacks and the identical dividend expense the prior quarter.

Microsoft continues to be about as near an ideal enterprise as attainable. The one drawback is that its success is well-known, which is why it is probably the most helpful firm on this planet and sports activities a 36.8 price-to-earnings ratio. It isn’t low-cost, however that is arguably a good worth for a corporation rising its high and backside line on the tempo of Microsoft, particularly when factoring in all its different qualities, like a rock-solid steadiness sheet and the quite a few benefits of its market place.

The inventory has made epic positive aspects in recent times, however the underlying enterprise is stronger than ever, giving buyers the inexperienced mild to purchase it in Might.

A compelling contrarian decide

Keith Speights (Pfizer): I am going to readily admit that Pfizer may appear like a horrible alternative for buyers to purchase in Might. Nonetheless, I believe there is a compelling contrarian case for this beaten-down huge pharma inventory.

Pfizer’s sinking income, earnings, and share worth share the identical perpetrator: falling demand for its COVID-19 merchandise. The excellent news, although, is that the corporate’s year-over-year comparisons ought to be much less difficult after this yr. Pfizer might even get pleasure from a rebound in COVID-19 gross sales if it wins approval for the mix COVID-flu vaccine presently in late-stage testing.

Some buyers fear about Pfizer’s looming patent cliff. A number of of the corporate’s high medicine face patent expirations over the subsequent few years, together with breast most cancers drug Ibrance and autoimmune illness drug Xeljanz. Pfizer tasks these losses of exclusivity will negatively impression its annual gross sales by roughly $17 billion by 2030.

I am assured the corporate will be capable of overcome these challenges. Why? Pfizer has launched a formidable variety of new merchandise (and new indications for already-approved medicine) within the final couple of years. It expects these launches will generate round $20 billion in extra annual income by 2030. Contemplating the caliber of the brand new merchandise and indications, I believe this goal is attainable.

Pfizer has additionally used the massive amount of money it created from its COVID-19 merchandise through the heyday of the pandemic to purchase smaller drugmakers. The corporate predicts that these offers and different transactions will enhance its annual income by $25 billion throughout the subsequent six years. This determine would not appear too excessive to me, particularly with the acquisition of Seagen closing in December 2023.

There are two different huge pluses for Pfizer: its dividend and its valuation. The drugmaker’s dividend yield tops 6.4%, which ought to enhance the inventory’s whole return properly. Pfizer’s shares commerce underneath 11.9 occasions ahead earnings — a giant discount in a market priced at a premium.

Time to rethink this dividend progress inventory

Neha Chamaria (NextEra Vitality): NextEra Vitality inventory misplaced almost 23% of its worth final yr as fears of a possible dividend minimize gripped buyers within the wake of persistently excessive rates of interest. NextEra Vitality, nevertheless, has continued to develop in latest months and simply reaffirmed its medium-term progress objectives, together with dividend progress. So, should you nonetheless have not thought-about including this utility dividend progress inventory to your portfolio, now’s the time.

NextEra Vitality lately delivered a powerful set of first-quarter numbers, rising its adjusted earnings per share (EPS) by 8.3% yr over yr. The corporate expects to develop its dividend per share by round 10% per yr by at the least 2026, off a 2024 base, pushed by a projected 6% to eight% progress in adjusted EPS for 2025 and 2026, respectively. Administration expects to hit its adjusted EPS vary’s high finish by 2026.

Two components ought to drive NextEra Vitality’s earnings and cash-flow progress — a steady conventional utility enterprise known as Florida Energy & Gentle Firm and a steadily rising renewable power arm named NextEra Vitality Assets (NEER). Whereas FPL is America’s largest utility, the primary quarter was NEER’s second-best quarter ever because it added almost 2.7 gigawatts (GW) of renewables to its portfolio. It now has a backlog of 21.5 GW, which is large, provided that NEER had roughly 36 GW in operation as of Dec. 31, 2023.

With NextEra Vitality additionally restructuring operations in latest months — together with promoting its pure gasoline belongings — to make sure it may well develop money flows and assist dividends even in a high-interest-rate surroundings, buyers who sidelined the three%-yielding inventory thus far have a very good cause to leap again in now.

Spring cleansing time

Demitri Kalogeropoulos (Dwelling Depot): Most retailers cannot wait till the Christmas vacation season, however for Dwelling Depot, it’s the spring that basically issues most to the enterprise. Shoppers flood its shops to buy seasonal merchandise, and impressive dwelling enchancment tasks get began in earnest as soon as the climate turns hotter throughout the U.S. That reality makes Might a vital month for the enterprise and its shareholders.

The house enchancment large is slated to report its fiscal first-quarter earnings outcomes on Might 16, proper in the midst of that demand surge. Administration will then have a clearer view of Dwelling Depot’s progress potential for the 2024 yr. Heading into the announcement, expectations are for comparable-store gross sales to say no by about 1% this yr after dropping 3% in 2023. Dwelling Depot is dealing with a progress hangover from the pandemic, mixed with weaker demand pushed by a softer housing market.

CEO Ted Decker and his group will replace buyers on these key challenges in a number of weeks. Along with these feedback, I will be watching Dwelling Depot’s buyer site visitors traits, which have been unfavorable final yr however improved to a 1.7% drop within the fiscal fourth quarter. One other transfer towards constructive outcomes could be a very good signal of stabilization forward.

In any case, this retailer inventory seems attractively priced after its latest decline. You may personal Dwelling Depot for two.2 occasions gross sales now, down from almost 3 occasions gross sales a number of weeks in the past. Certain, the prospect of extra sluggishness within the housing market raises the chance that the chain will see weaker gross sales over the subsequent few quarters. Nonetheless, Dwelling Depot has thrived by many earlier business downturns and is prone to set annual earnings data in a number of years.

This pandemic winner by no means stopped rising

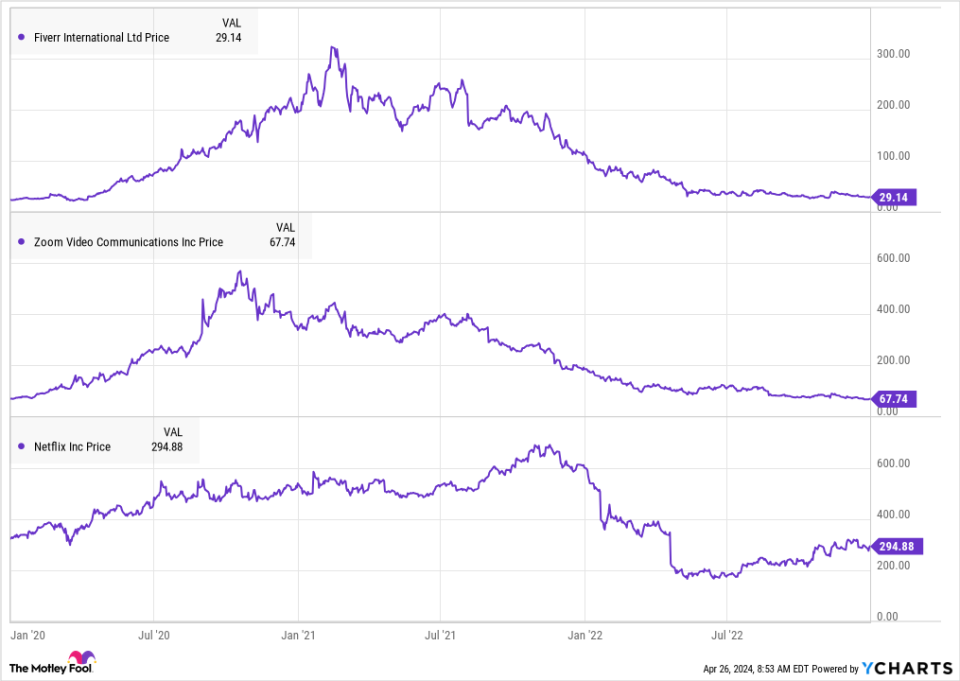

Anders Bylund (Fiverr): Many buyers noticed Fiverr Worldwide as a pandemic play. The freelance providers wrangler’s inventory soared within the lockdown section of the COVID-19 disaster, then began an extended and painful plunge when vaccines turned broadly out there, and the period of distant work ran right into a brick wall. The inventory’s trajectory from 2020 to 2022 is strikingly much like different lockdown winners, similar to Netflix and Zoom Video Communications:

As of late, Wall Road is embracing Netflix’s long-term marketing strategy once more, however Zoom and Fiverr are buying and selling roughly 90% under their four-year highs.

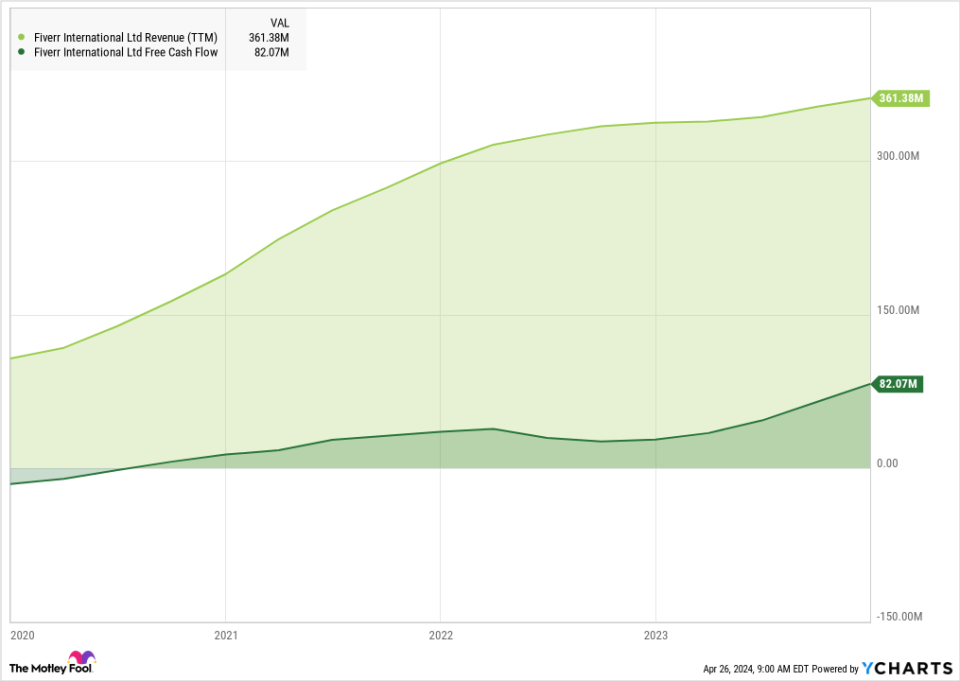

And Fiverr by no means bought the memo about that growth-ending brick wall.

After a short inflation-based pause, Fiverr’s high line is again to strong progress once more, and the corporate by no means stopped making a living:

Fiverr’s 4.1 million lively freelance service consumers are growing their common spending whereas Fiverr hangs on to a bigger slice of the charges per service.

The most recent bearish argument in opposition to Fiverr is the AI increase. Critics say that human freelancers are much less related in a world of highly effective generative AI instruments. However Fiverr’s administration disagrees — human consultants are nonetheless controlling the AI bots, a preferred service class on Fiverr’s market.

“Total, we estimate AI created a web constructive impression of 4% to our enterprise in 2023, CEO Micha Kaufman mentioned in February’s fourth-quarter earnings name. “We see a class combine shift from easy providers similar to translation and voice-over to extra complicated providers similar to cell app improvement, e-commerce administration or monetary consulting.”

Does that sound like an out of date enterprise on its deathbed? I do not suppose so, however that is what Fiverr’s inventory chart seems like. Shares are altering palms for lower than 10 occasions free money flows and a couple of.2 occasions gross sales, and each of the underlying monetary metrics are rising rapidly.

Fiverr is scheduled to report earnings once more on Might 8. I am unable to promise that this replace will flip the inventory chart round in a rush. In due time, the regular drumbeat of robust experiences ought to launch Fiverr from inaccurate investor worries. This inventory might have been too expensive in 2021 however it additionally seems deeply undervalued right this moment.

The place to speculate $1,000 proper now

When our analyst group has a inventory tip, it may well pay to hear. In any case, the publication they’ve run for twenty years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They only revealed what they consider are the 10 finest shares for buyers to purchase proper now… and Microsoft made the record — however there are 9 different shares chances are you’ll be overlooking.

*Inventory Advisor returns as of April 22, 2024

Anders Bylund has positions in Fiverr Worldwide and Netflix. Daniel Foelber has no place in any of the shares talked about. Demitri Kalogeropoulos has positions in Dwelling Depot and Netflix. Keith Speights has positions in Fiverr Worldwide, Microsoft, and Pfizer. Neha Chamaria has positions in Pfizer. The Motley Idiot has positions in and recommends Fiverr Worldwide, Dwelling Depot, Microsoft, Netflix, NextEra Vitality, Pfizer, and Zoom Video Communications. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

5 High Shares to Purchase in Might was initially revealed by The Motley Idiot