-

Fundstrat’s Tom Lee expects the S&P 500 to prime 15,000 by 2030.

-

Demographic developments, millennial spending habits, and know-how developments shall be key drivers.

-

Listed here are the 4 charts that present why Lee is so bullish on the inventory market.

Fundstrat’s Tom Lee raised eyebrows final month when he made a particularly bullish prediction: the S&P 500 will almost triple by 2030.

In an interview with Bloomberg’s Odd Tons, Lee stated he expects the S&P 500 to prime 15,000 by the tip of the last decade. The index traded at round 5,630 on Friday.

“If it is a regular S&P cycle following demographics…S&P must be probably 15,000 by the tip of the last decade. To me, as you progress into an extended timeframe that is most likely the place I feel we’re shifting in direction of,” Lee stated.

Within the interview, Lee stated he was a handful of charts that again up his bullish long-term prediction.

Listed here are the 4 charts Lee shared with Enterprise Insider that present why the already upbeat forecaster is so bullish on the inventory market.

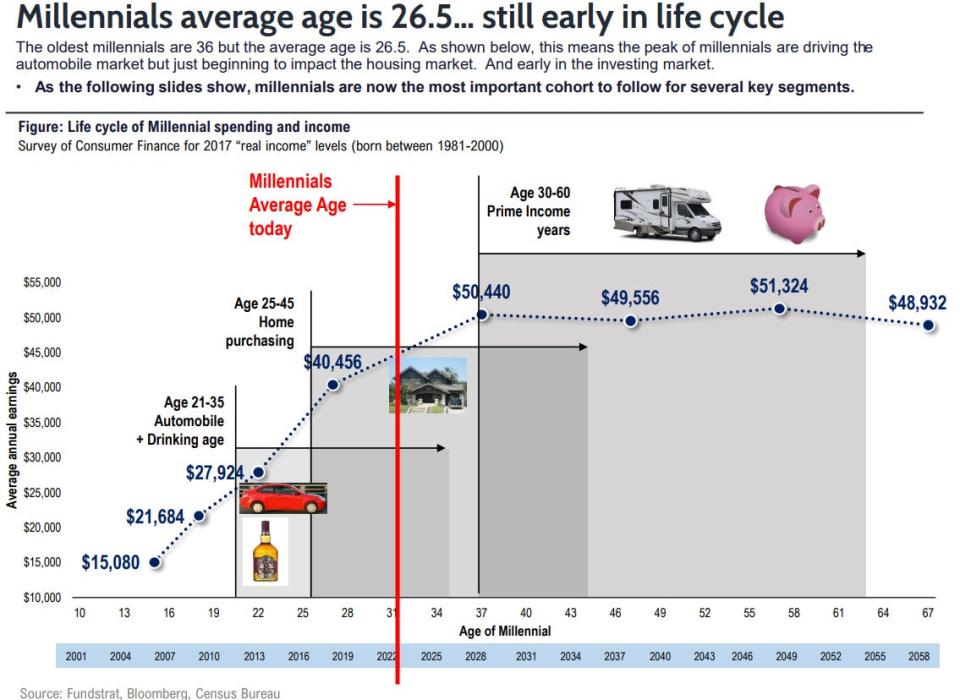

1. Thanks, millennials

Lee put the chart above collectively a number of years in the past, however his thesis stays the identical. The typical age of millennials is now round 31 years outdated, and the worldwide cohort of two.5 billion individuals is beginning to enter its prime age years of 30-50 years outdated.

“This might be the third time that shares entered a cycle the place annual returns compound at excessive teenagers. You had the roaring 20’s, and you then had the 50’s by way of the late 60’s, and it is a third cycle,” Lee advised CNBC final month.

“All of them coincided with a surge within the variety of individuals aged 30-50, so in different phrases the variety of prime age adults, and this time it is powered by millennials and Gen Z.”

“It is a demand story. If you get to your prime years, 30-50, City Institute exhibits you begin to borrow more cash, you make huge life selections, that is what powers the financial system.”

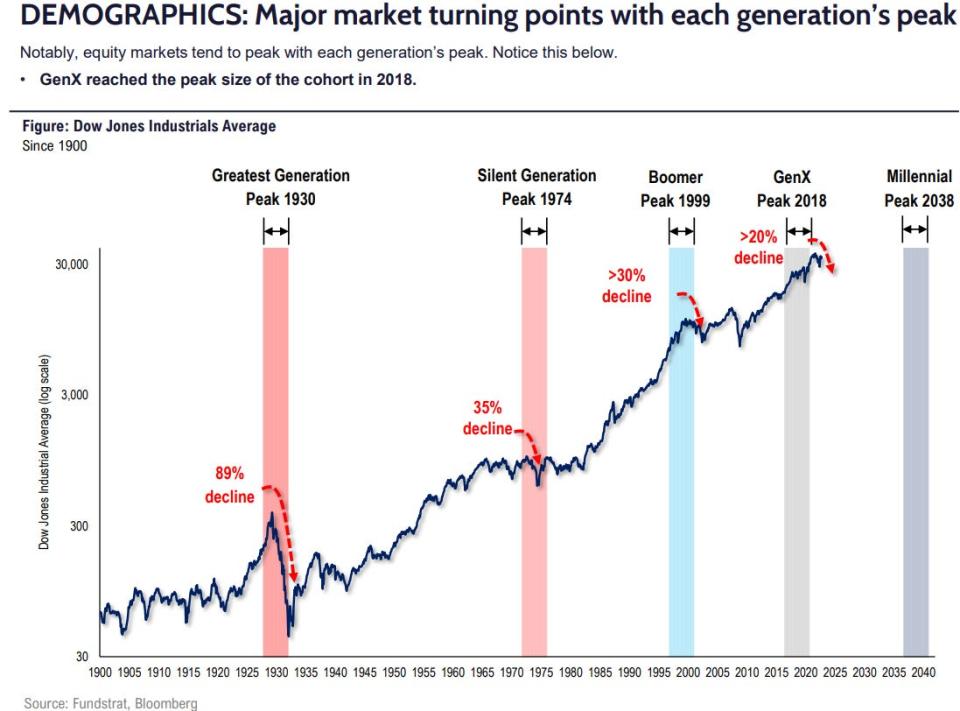

2. Inventory market peaks and demographics

The inventory market has a historical past of peaking proper across the similar time a inhabitants hits its peak prime age of round 50 years outdated, as they’re nearer to retirement and infrequently spend much less cash.

For instance, when the best technology peaked in 1930, that coincided with a multi-year bear market in shares.

Quick-forward to 1974, when the silent technology noticed its prime age peak. This occurred across the similar time as a painful inventory market correction of about 35% that lasted years.

And the height within the child boomer inhabitants’s prime age was in 1999, only a yr earlier than a multi-year bear market hit shares.

The typical millennial shouldn’t be set to hit their peak prime age till 2038, suggesting loads of upside forward for the inventory market between every now and then, in accordance with Lee.

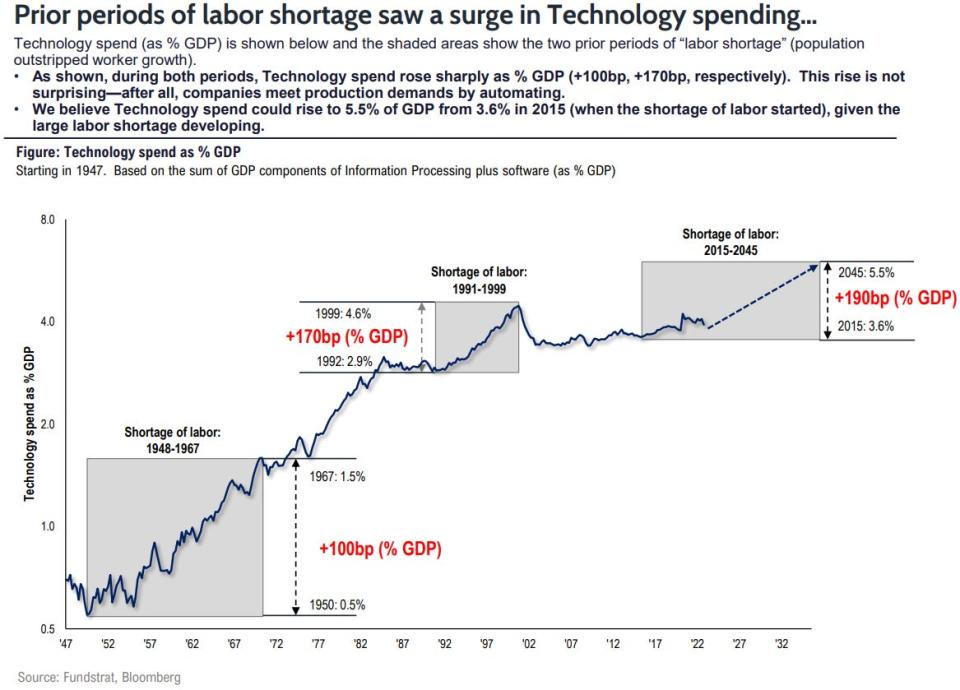

3. Tech will handle a world labor scarcity

In keeping with Lee, spending on know-how will growth within the coming years because the world grapples with a rising labor scarcity.

“We now have a extremely huge alternative for US know-how firms due to AI, which is supplying the worldwide digital labor, as a result of there is a international labor scarcity. So these two forces are combining to I feel energy virtually a decade of terribly good inventory returns,” Lee stated.

“I feel that there is going to be plenty of {dollars} spent on US know-how product as a result of the world is brief 80 million staff by the tip of this decade, that is roughly $3 trillion of labor wage that is turning into silicon, so which means US suppliers of silicon and AI are going to have a $3 trillion income run price.”

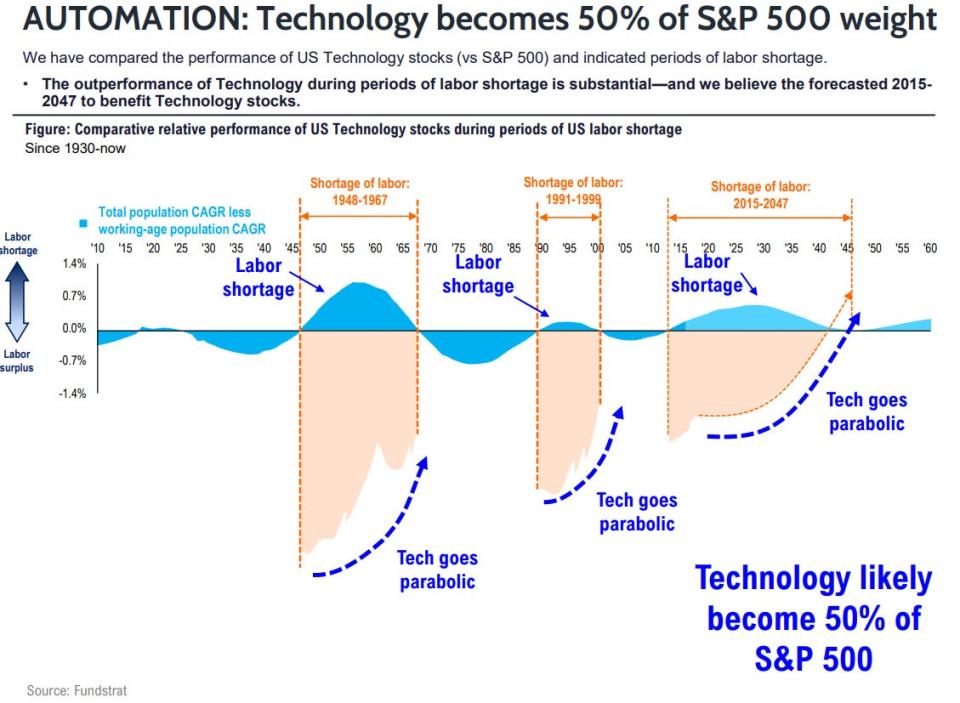

4. Cash will movement into US tech shares

As extra firms spend trillions of {dollars} on know-how to handle a world labor scarcity, that may catapult the know-how sector to make up 50% of the S&P 500.

The data know-how sector presently makes up about 30% of the index.

“If US firms are rising earnings at this velocity, the P/E a number of of the US ought to go up. There’s going to be capital flows into the US. The place else on the earth do you discover one of the best and most necessary know-how firms, they’re all principally in America,” Lee stated.

Learn the unique article on Enterprise Insider