Trying on the inventory market over the previous decade, you will see that many top-performing shares have been tech corporations. Current developments have made tech shares extremely engaging and pushed their valuations up — a lot in order that seven of the world’s 10 Most worthy corporations are within the tech sector.

No matter how spectacular many tech shares’ features have been, it is necessary to recollect the worth of persistence in investing. The main focus ought to at all times be on the long run.

Whereas the previous decade has been profitable for a lot of buyers in tech shares, the following decade might be simply as promising. The next three corporations are ones buyers ought to contemplate shopping for and holding for the following decade. There will definitely be bumps alongside the way in which, however there is a good probability you will look again and be glad you invested in them now.

1. Snowflake

Snowflake (NYSE: SNOW) operates a cloud-based information platform that enables customers to combination, analyze, and share information throughout numerous platforms. Traders had a lot of excessive expectations for the corporate across the time of its preliminary public providing (IPO), however since then, it has been a narrative of highs and lows.

In its fiscal 2025 first quarter (which ended April 30), Snowflake generated $829 million in income, which beat the consensus estimate. Nonetheless, the corporate got here up wanting earnings estimates, and the inventory continued the slide that started in March.

Sure, Snowflake’s year-over-year income progress has slowed, however its remaining efficiency obligation — income it may possibly anticipate below current contracts — is up 46% from final yr to $5 billion, and administration famous that after a interval when some have been hesitating to take action, extra of its clients are starting to make longer-term commitments.

Snowflake famous on its final earnings name that it expects margins to say no within the subsequent yr because it spends considerably on new graphics processing items (GPU) to assist its AI initiatives, however that seems to be a obligatory funding in infrastructure for it to realize what it calls “significant income era” within the subsequent few years.

Like many different tech corporations, Snowflake is betting large on AI and hoping to drive progress and bolster its choices by the rising know-how. Add that to the projected progress of the massive information business, and Snowflake’s long-term worth proposition turns into intriguing, particularly contemplating its valuation is now near the bottom it has been since its IPO.

2. CrowdStrike

There are a lot of advantages to the world changing into extra digitally related, however one notable draw back is that it will increase the alternatives for hackers to conduct cyberattacks. The worldwide annual value of cyberattacks in 2017 was round $700 billion. Based on a forecast by the researchers at Statista, by 2028, that annual value can be over $13.8 trillion. That is the place CrowdStrike (NASDAQ: CRWD), one of many world’s premier cybersecurity corporations, comes into the image.

CrowdStrike was one of many pioneers of AI-native cybersecurity options and has rapidly change into a go-to supplier for lots of the world’s high corporations, together with 62 members of the Fortune 100. Though AI has attracted mainstream consideration prior to now couple of years, CrowdStrike has been utilizing it for its safety options from the start, giving it an information benefit over different cybersecurity corporations that got here later to the AI social gathering.

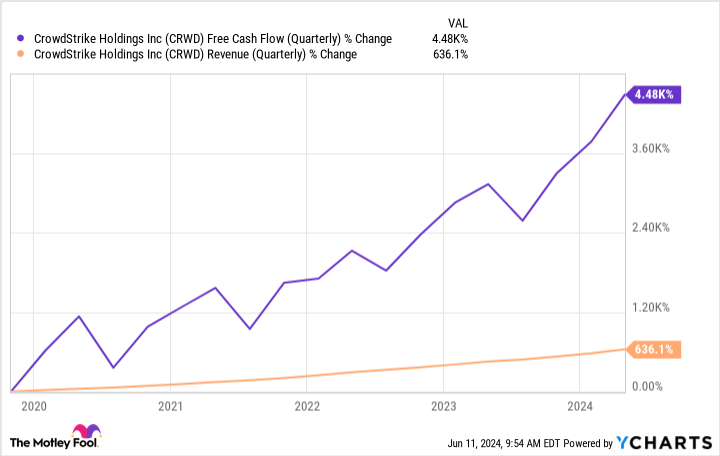

The effectiveness of CrowdStrike’s platforms may be seen in its buyer progress and retention. Round 65% of its clients use 5 or extra of its modules (software program designed for a selected perform), 44% use six or extra, 28% use seven or extra, and the variety of offers involving eight or extra modules grew by 95% yr over yr final quarter. This has additionally propelled CrowdStrike’s financials.

Cybersecurity is now a non-negotiable expense for a lot of companies globally, and the quantity ought to solely improve. With a price-to-sales ratio of round 23.5, CrowdStrike trades at a premium to its friends, however for buyers who’ve time on their facet, its progress price and progress alternatives make {that a} justifiable premium to pay.

3. Microsoft

Having been round for many years, Microsoft (NASDAQ: MSFT) stands out from the opposite two corporations on this record, however even because the world’s Most worthy public firm, it nonetheless has plenty of room for progress.

One key motive to carry onto Microsoft’s inventory for the following decade is the way in which the corporate is intertwined with the worldwide enterprise world.

Take into consideration all of the services that Microsoft provides that many companies depend on of their day by day operations — Workplace merchandise (Excel, Phrase, Outlook, Groups, and so forth.), Azure, Home windows, and dozens of different enterprise options.

Its place as a core provider of providers to the worldwide enterprise world insulates Microsoft from the impacts of financial downturns in comparison with a lot of its tech counterparts and offers it long-term stability. When financial circumstances are lower than preferrred, it is a lot simpler to delay upgrading gadgets or reduce on promoting than it’s to cancel your cloud service, cease utilizing important productiveness instruments, or do with out IT infrastructure assist.

Microsoft’s significance to the worldwide enterprise world ensures it is going to be a dominant participant within the tech area for a while.

Must you make investments $1,000 in Snowflake proper now?

Before you purchase inventory in Snowflake, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Snowflake wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $802,591!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Stefon Walters has positions in Microsoft. The Motley Idiot has positions in and recommends CrowdStrike, Microsoft, and Snowflake. The Motley Idiot has a disclosure coverage.

3 Tech Shares You Can Purchase and Maintain for the Subsequent Decade was initially printed by The Motley Idiot