Should you had been in a position to determine upfront the uncommon shares that would flip $1,000 right into a cool million, you would not need to do a lot to be set for all times. However nobody has a crystal ball, which is why diversification is simply as vital as selecting high shares. There are all kinds of things that would ship any given inventory plummeting or skyrocketing, and you’ll by no means know which of them will carry the day (or week, or month, or 12 months).

The exhausting a part of investing is not essentially arising with the funds to take a position or agonizing over company monetary statements. Typically, the toughest half is sustaining the fortitude to hold on to your investments by way of the robust instances and let the magic of compound development do its work.

Think about Amazon (NASDAQ: AMZN), Walmart (NYSE: WMT), and House Depot (NYSE: HD). Every of those shares has had main downswings at instances, however for those who’d invested $1,000 in any of them after they went public, you’d have greater than $1 million in the present day.

The Amazon of e-commerce

Amazon’s total returns have been among the highest within the historical past of the inventory market. Should you’d invested $1,000 in Amazon inventory on the time of its preliminary public providing (IPO), you’d have nearly $1.9 million in the present day.

As you possibly can see within the chart, that features a main downturn in 2022, along with different bumps alongside the street. What’s taking place in the present day? Amazon continues to be reporting double-digit share development, a really outstanding feat given the dimensions of the bottom it is constructing on. Much more, it nonetheless has unimaginable alternatives in synthetic intelligence on high of robust potential in its core e-commerce enterprise.

The biggest retailer on this planet

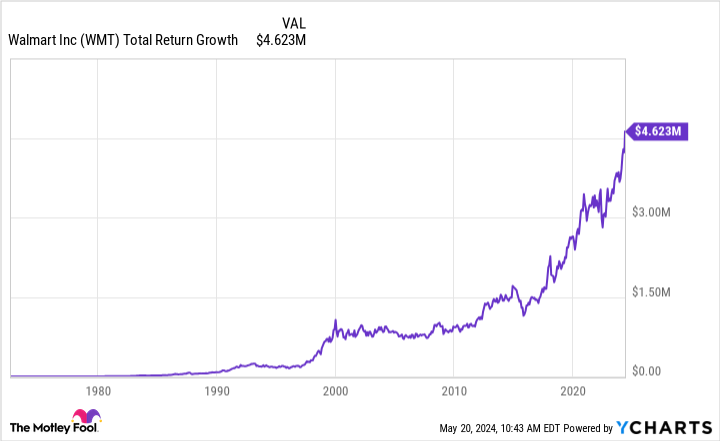

Walmart is not a development inventory anymore, however despite the fact that it retains trying like Amazon is rising quick sufficient to take over because the world’s largest retailer, the e-commerce powerhouse hasn’t been in a position to knock it from the highest spot. The low cost chain continues to be rising at about mid-single-digit share charges, which is actually spectacular contemplating its gargantuan dimension. Walmart has been a public firm rather a lot longer than Amazon, and for those who’d invested $1,000 in it in 1970 with dividends reinvested, you’d have greater than $4.6 million in the present day.

It does seem that Amazon will dethrone it one in every of today, however Walmart has been doing every kind of issues to generate development and keep on high. It is becoming a member of the streaming area to leverage an promoting enterprise and fine-tuning its merchandise in numerous areas to raised meet regional demand. It might ultimately lose the world’s largest retailer title, nevertheless it will not lose its standing as a superb enterprise. Plus, it pays a rising dividend.

A millionaire-maker which may shock you

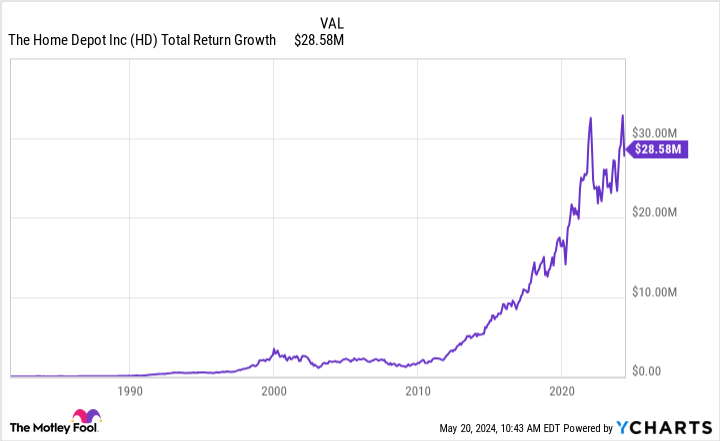

You might need anticipated to see Amazon and Walmart on this listing, however you may be shocked that House Depot is right here. In any case, it is a area of interest retailer. However for those who’d invested $1,000 in its inventory early sufficient, your House Depot holding can be price far more now than for those who’d invested within the IPOs of both Amazon or Walmart.

House Depot is a superb enterprise, and in the present day it enjoys a robust moat because of its investments in expertise and its dominant place inside its area of interest. It is feeling some stress within the present macroeconomic atmosphere, and its inventory worth — after some ups and downs — is near flat thus far this 12 months, so this could possibly be a superb time to purchase in. Within the meantime, it pays a aggressive and rising dividend, and reinvesting it accounts for $12 million of the entire return.

Can they nonetheless make you millionaires?

From their present huge sizes, it is roughly unattainable for these three firms to extend in worth once more by 1,000 instances or extra, so $1,000 invested in these firms in the present day will not make you a millionaire. Nevertheless, they’ve all demonstrated that they’ve nice enterprise fashions, and so they may nonetheless create loads of extra worth for his or her shareholders over time. Not each inventory will make you a millionaire, however diversification in your portfolio might help you get there.

I need to end by clarifying that that is an train to deliver residence the worth of long-term investing. Most retail traders do not get to spend money on any firms at their IPOs, and few shares have achieved the accomplishment of turning $1,000 into $1 million. However traders who begin early, spend money on nice firms, and maintain onto their investments for the lengthy haul in order that their development can compound over time can undoubtedly create wealth and develop into millionaires.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Amazon wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $635,982!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 13, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jennifer Saibil has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, House Depot, and Walmart. The Motley Idiot has a disclosure coverage.

3 Shares That Turned $1,000 Into $1 million was initially printed by The Motley Idiot