Since Warren Buffett assumed management of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) in 1965, the multinational holding firm has achieved a outstanding compound annual development price of 19.8% by means of 2023, almost doubling the benchmark S&P 500‘s 10.2% complete return over the identical interval.

Given the unparalleled returns, it is at all times sensible to look at Berkshire’s present holdings to see which shares the Oracle of Omaha believes are price proudly owning. Listed below are three picks that align with Buffett’s timeless funding ideas and exhibit long-term potential for shareholders.

1. American Categorical

American Categorical is a Buffet favourite, making up almost 10% of Berkshire’s inventory portfolio. Buffett’s preliminary funding within the funds and bank card firm dates again to 1991, and since then, it has achieved a outstanding return, rising from $1.3 billion to about $35.5 billion in worth. Notably, the appreciation doesn’t embody dividends, which started at $41 million yearly and are estimated to be $409 million in 2024.

With returns like that, some traders might imagine American Categorical’s greatest days are over, however there’s nonetheless loads to love concerning the firm. First, American Categorical lately reported $15.8 billion in income and diluted earnings per share (EPS) of $3.33 for its first quarter of 2024, a year-over-year improve of 11% and 39%, respectively. Administration reaffirmed its bullish outlook for 2024, together with income development between 9% and 11%, and a diluted EPS improve of 13% to 17%, setting report highs if realized.

American Categorical operates in another way from its rivals, Mastercard (NYSE: MA) and Visa (NYSE: V), in that it serves as a closed-loop community by issuing playing cards, extending credit score to card customers, and holding the loans on its books. This lets it cost larger service provider charges and annual charges for cardholders. In consequence, it’s extra inclined to defaults and should report a non-cash expense referred to as provisions for credit score losses for any anticipated losses that may probably be unrecoverable over the following yr. With elevated rates of interest weighing on some companies and customers, this metric is on the rise for American Categorical, reaching $1.3 billion for Q1 2024, a year-over-year improve of 18%.

Nonetheless, American Categorical has $5.4 billion web money on its steadiness sheet, and its administration prioritizes returning capital to shareholders. Past that, the corporate has paid a dividend since 1989, with a present quarterly dividend of $0.70 per share, representing an annual yield of 1.2%. Whereas American Categorical does not at all times elevate its dividend annually, Buffett famous in his 2022 annual letter to shareholders that he expects the dividend is “extremely more likely to improve.”

Lastly, American Categorical administration aggressively repurchases its inventory, decreasing it shares excellent by almost 14% through the previous 5 years, and the board is allowed to repurchase one other estimated 95 million shares out of its present 719 million. To cite Buffett once more, “The mathematics is not difficult: When the share rely goes down, your curiosity in our many companies goes up.”

2. Mastercard

The second Berkshire inventory to contemplate including to your portfolio is one other fee behemoth: Mastercard. As of Dec. 31, Berkshire held almost 4 million shares. Berkshire’s stake in Mastercard and Visa was initiated by its portfolio managers Todd Combs and Ted Weschler, and never Buffett. However Buffett did word at considered one of Berskhire’s annual conferences, “I might have purchased them as nicely, and looking out again, I ought to have.”

Mastercard is the second-largest fee processor by market capitalization at $432 billion and has narrowly outpaced the entire return of the S&P 500 over the previous 5 years, 95% in comparison with 87%.

Mastercard, like Visa, operates as an open-loop community: It expenses a price every time a cardholder pays with a Mastercard, although the financial institution that issued the cardboard holds the mortgage. Mastercard generated $25.1 billion in income over the trailing 12 months and has a five-year income compound annual development price of 10.9%, surpassing Visa’s 9.6%. That larger compound annual development price additionally contributes to Mastercard’s larger valuation with a price-to-earnings (P/E) ratio of 39 in comparison with Visa’s 32. And regardless of elevated rates of interest, shopper spending is wholesome, with Mastercard Chief Monetary Officer Sachin Mehra noting throughout its most up-to-date earnings name that “shopper spending continues to be supported by a robust labor market and wage development.”

Past its financials, Mastercard has paid a quarterly dividend since going public in 2006 and has raised it for the previous 13 consecutive years. In the present day, Mastercard pays a quarterly dividend of $0.66 per share, equating to an annual yield of 0.6%. Additionally, administration repurchased $9 billion price of inventory in 2023, and lowered its shares excellent by 8.7% through the previous 5 years.

3. Visa

In the event you did not discover a theme by now, it ought to be apparent with the final Berkshire inventory: Visa. The corporate, with a market capitalization of $562 billion, is the chief within the consumer-payments market with 4.4 billion issued playing cards, producing $33.4 billion in income and $18 billion in web revenue over the trailing 12 months.

Like its rivals, Visa rewards shareholders with dividends and share repurchases. First, Visa at present pays a quarterly dividend of $0.52 per share, equating to an annual yield of about 0.8%. The funds big has elevated its dividend for 15 consecutive years, main its friends in that class. Subsequent, the corporate repurchased $2.7 billion price of its inventory in its most up-to-date quarter, leaving $23.6 billion of remaining approved funds for share repurchases.

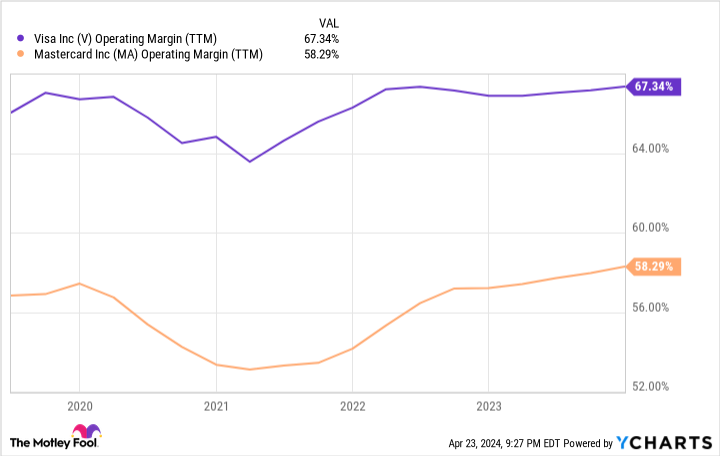

The place Visa excels in comparison with its direct competitor, Mastercard, is its working margin — a proportion of income an organization retains as working revenue. Visa’s working margin through the 12 trailing months is 67.4%, considerably wider than Mastercard’s 58.3% throughout the identical interval. Put one other manner, Visa is extra environment friendly at turning income into revenue than Mastercard. As beforehand famous, Visa trades at a decrease P/E ratio than Mastercard, making its inventory a greater valuation.

One space to observe for Visa is its complete funds quantity development — or the variety of transactions. Administration lately lowered its estimate for its fiscal 2024 from low double-digit percentages to excessive single digits in comparison with its fiscal 2023, pointing blame at slower-than-expected journey quantity in Asia-Pacific.

The slight downgrade may very well be because of the larger rates of interest affecting customers. Nonetheless, Visa CFO Chris Suh stays constructive, lately noting, “Our information doesn’t point out any significant habits change throughout shopper segments.”

Are these three Warren Buffett shares price shopping for?

Buffett as soon as mentioned, “Funds are an enormous deal worldwide,” which is mirrored in Berkshire’s portfolio with these three shares. Given Berkshire Hathaway’s public filings, we are able to see that probably the most distinguished and longest wager is on American Categorical with a $35 billion stake. However as an investor, you do not have to decide on only one. On Visa’s most up-to-date earnings name, its administration mentioned the corporate’s complete addressable market is $20 trillion, which means there’s loads of development potential. Contemplating these are the three largest corporations within the funds trade in the present day, there may be nothing improper with shopping for all three.

Must you make investments $1,000 in American Categorical proper now?

Before you purchase inventory in American Categorical, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and American Categorical wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $506,291!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 22, 2024

American Categorical is an promoting accomplice of The Ascent, a Motley Idiot firm. Collin Brantmeyer has positions in American Categorical, Berkshire Hathaway, Mastercard, and Visa. The Motley Idiot has positions in and recommends Berkshire Hathaway, Mastercard, and Visa. The Motley Idiot recommends the next choices: lengthy January 2025 $370 calls on Mastercard and brief January 2025 $380 calls on Mastercard. The Motley Idiot has a disclosure coverage.

3 No-Brainer Warren Buffett Shares to Purchase Proper Now was initially revealed by The Motley Idiot