In simply 5 a long time or so, know-how has improved by leaps and bounds, shifting us from massive mainframe computer systems within the Seventies to smartphones with web connectivity within the 2020s. The excellent news is that these developments nonetheless have a protracted method to go. Synthetic intelligence (AI), digitalization, and cloud computing signify the way forward for how we work and talk and companies are leaping on these long-term tendencies.

Traders who’re searching for funding concepts ought to flip their consideration to the know-how sector, the place many stable development shares could be discovered. A variety of corporations are benefiting from this digitalization shift and may see a pointy surge in demand for his or her merchandise, companies, and options. Proudly owning such shares over the long run means you get to trip this pattern and revel in enticing capital beneficial properties that may set you up in your retirement.

Listed here are three shares you could purchase to reap the benefits of this technological wave.

Microsoft

Microsoft (NASDAQ: MSFT) is a know-how behemoth with a market capitalization exceeding $3 trillion. The corporate sells and markets its Microsoft 365 suite of software program functions and owns the enterprise networking website LinkedIn. Regardless of its large dimension, buyers could also be stunned to study that the enterprise remains to be demonstrating regular development. From fiscal 2021 (the corporate has a June 30 fiscal year-end) to fiscal 2023, whole income jumped from $168.1 billion to $211.9 billion. Internet revenue elevated from $61.3 billion to $72.4 billion over the identical interval. The software program large additionally generated a mean free money stream of round $60.2 billion over the three fiscal years. Microsoft’s dividend historical past has additionally been stellar, with the corporate elevating its quarterly dividend with out fail since fiscal 2010. The newest quarterly dividend stood at $0.75, up from $0.68 a yr in the past.

The corporate’s momentum has carried over the primary 9 months of fiscal 2025. Income rose practically 16% yr over yr to $180.4 billion whereas working revenue improved by nearly 27% yr over yr to $81.5 billion. Internet revenue stood at $66.1 billion for the nine-month interval, up 26% yr over yr. Microsoft has carried on its custom of producing copious quantities of free money stream, with $50.7 billion churned out in the course of the 9 months, up 28% yr over yr. The Redmond-based firm has carried out acquisitions and cast collaborations to proceed rising its enterprise. Again in 2019, Microsoft and OpenAI fashioned a partnership to construct a supercomputing platform for the previous’s cloud service, Microsoft Azure. A number of years later in 2022, Microsoft bought Activision Blizzard for $68.7 billion to develop its gaming phase. Extra lately, the corporate invested $1.5 billion in G42, a UAE-based synthetic intelligence firm to allow the nation to turn out to be a world AI hub. Microsoft additionally introduced that it’s working with ServiceNow, a digital workflow administration firm, to develop its strategic alliance and work on generative AI capabilities. Final month, the software program large cast an settlement with Japanese electronics firm Hitachi to faucet into generative AI to create progressive enterprise options. These enterprise improvement efforts ought to pave the way in which for Microsoft to proceed increasing its presence and permit the corporate to extend its dominance within the know-how world.

Broadcom

Broadcom (NASDAQ: AVGO) helps to design and develop a variety of semiconductor, enterprise software program, and safety options. The corporate seems to be set to trip the surge in demand for AI, which ought to translate into extra enterprise for its vary of options. Broadcom’s financials are stable — income grew from $27.5 billion for fiscal 2021 (ending October) to $35.8 billion for fiscal 2023. Internet revenue did even higher, greater than doubling from $6.4 billion to $14.1 billion over the identical interval. The enterprise additionally generated steadily greater free money stream, going from $13.3 billion in fiscal 2021 to $17.6 billion in fiscal 2023. It paid an annual dividend of $1.84 per share, 12% greater than the $1.64 paid out a yr in the past.

Broadcom continued to report greater income for the primary half of fiscal 2024, however web revenue was impacted by greater analysis and improvement bills and restructuring prices. Income for the primary half of the yr elevated 38% yr over yr to $24.4 billion however web revenue fell by greater than half to $3.4 billion. The corporate had accomplished its acquisition of VMWare, an organization coping with enterprise software program, for round $61 billion again in November 2023 and the numbers replicate the consolidated outcomes of each companies. It declared a quarterly dividend of $0.525 per share, taking the annualized dividend to $2.10 per share for a 14% year-over-year enhance. Administration is assured in regards to the future and has raised its steering for fiscal 2024 income to return in at $51 billion, or near 43% greater than that reported for fiscal 2023. With the proliferation of generative AI and the necessity for enterprise options and extra complicated semiconductors, Broadcom is nicely positioned to learn within the coming years.

Utilized Supplies

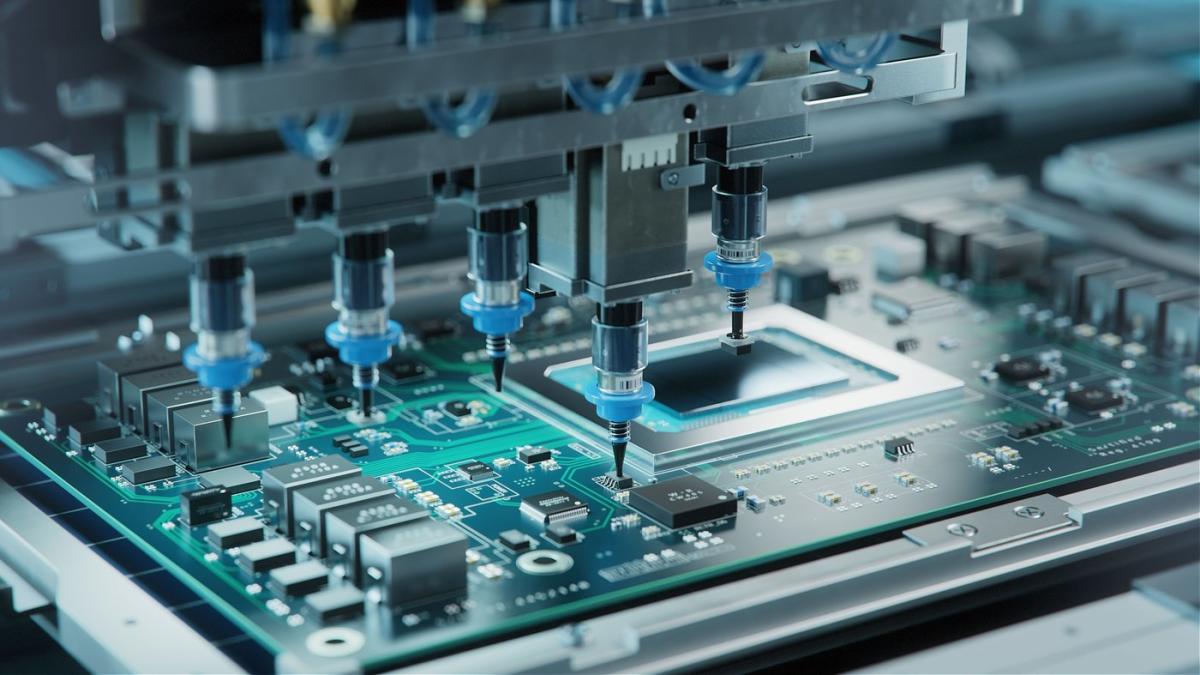

Utilized Supplies (NASDAQ: AMAT) produces and provides wafer fabrication tools and software program that’s used to supply microchips for smartphones, televisions, and flat-panel shows. The corporate is poised to trip the pattern for extra complicated semiconductor chips because it constantly delivers enhancements in its tools to allow extra environment friendly computing. Utilized Supplies’ monetary numbers have been strong over time and look set to proceed enhancing as demand will increase for its tools. Income elevated from $23.1 billion to $26.5 billion from fiscal 2021 (ended Oct. 31) to fiscal 2023. Internet revenue climbed from $5.9 billion to $6.9 billion over the identical interval, and the enterprise additionally generated constructive free money stream for all three years. Utilized Supplies has additionally been growing its quarterly dividend at a powerful tempo since fiscal 2017, with fiscal 2023 and 2024 seeing a 23% and 25% year-over-year enhance to $0.32 and $0.40 per share, respectively.

Utilized Supplies continued to put up a powerful set of earnings for the primary half of fiscal 2024. Though income remained flat yr over yr at $13.3 billion, web revenue improved by 14% yr over yr to $3.7 billion. The corporate continues to churn out constructive free money stream for the primary half of fiscal yr 2024, and administration issued sturdy steering for its third quarter. The corporate expects income to return in at round $6.65 billion, above analysts’ estimates of $6.58 billion. Adjusted web revenue per share is projected to be within the vary of between $1.83 and $2.19, on the greater finish of analysts’ estimates of $1.98. There may very well be extra to return for the enterprise as administration sees catalysts that may drive the corporate’s efficiency ahead. The semiconductor system market grew 15% yr over yr within the first quarter of 2024 with cloud service suppliers asserting bold capital expenditure plans. The corporate has additionally introduced its intention to double its manufacturing capability, headcount, and analysis actions in Singapore within the coming years. Utilized Supplies additionally lately introduced chip wiring improvements that entrench it firmly on the forefront of progressive analysis. The corporate would be the first to make use of ruthenium in high-volume manufacturing to allow extra environment friendly manufacturing of the two nanometer chip, whereas its new enhanced dielectric materials, Black Diamond, helps to strengthen chips for 3D stacking and is being adopted by main logic and dynamic RAM chipmakers. With wholesome sector tailwinds and its eager deal with analysis to enhance its technological edge, Utilized Supplies is a inventory that may ship many extra years of wholesome development.

Must you make investments $1,000 in Microsoft proper now?

Before you purchase inventory in Microsoft, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Microsoft wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $757,001!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 22, 2024

Royston Yang has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Utilized Supplies and Microsoft. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 High Tech Shares to Purchase Proper Now was initially printed by The Motley Idiot