Enterprise Merchandise Companions (NYSE: EPD) is the type of earnings inventory that even probably the most conservative buyers will fall in love with. The record of positives features a conservative enterprise mannequin in a extremely unstable sector, a big yield, and a powerful monetary basis.

If that sounds good to you, here is a more in-depth take a look at every level because it pertains to this vitally vital midstream vitality firm.

1. Enterprise Merchandise Companions is boring

Oil and pure gasoline costs can change into fairly thrilling at occasions, as each are ceaselessly topic to huge and speedy swings. Given the affect of the commodities’ costs on the monetary efficiency of vitality producers, the vitality sector as an entire is mostly seen as unstable.

However there’s one area of interest that operates in a really completely different method: the midstream sector. That is the place Enterprise Merchandise Companions operates.

Midstream gamers like Enterprise personal pipelines, together with storage and transportation infrastructure. These are important property that join the upstream sector (drilling) to the downstream (refining and chemical compounds) and to the remainder of the world.

Midstream corporations usually cost charges for the usage of their property, making them toll-taker companies. That implies that vitality demand is extra vital than vitality costs to monetary efficiency at Enterprise. And vitality demand tends to be sturdy even when vitality costs are low.

Enterprise is not thrilling — it simply helps transfer oil and pure gasoline round — and that is going to be an enormous plus for buyers who like consistency.

2. Enterprise has an enormous, dependable yield

As a grasp restricted partnership (MLP), Enterprise is particularly designed to cross earnings on to unitholders. So a excessive yield should not be stunning, per se. However its 7.2% yield will nonetheless be very compelling for income-focused buyers.

Evaluate that determine to the yield from the S&P 500 index, which is a scant 1.3%. Or to the broader vitality sector, which is yielding round 3.1% utilizing Power Choose Sector SPDR Fund as an business proxy. It’s arduous to beat Enterprise Merchandise Companions in case you are in search of passive earnings within the vitality sector.

And there is one other very enticing reality right here: The corporate has elevated its distribution every year for 25 consecutive years. The annualized development of the distribution has averaged 7%, which is fairly spectacular.

To be clear, more-recent will increase have not lived as much as that determine, so buyers ought to go in solely anticipating mid-single-digit hikes. However the true story is the lofty yield, not lofty distribution development. Yield will, ultimately, make up the lion’s share of an investor’s return.

3. Enterprise has a rock-solid monetary basis

In fact, the yield is simply nearly as good because the distribution is robust. And by chance, Enterprise scores very properly on monetary energy. The lengthy streak of annual distribution will increase speaks to that energy, however there are extra direct methods to evaluate the monetary basis right here.

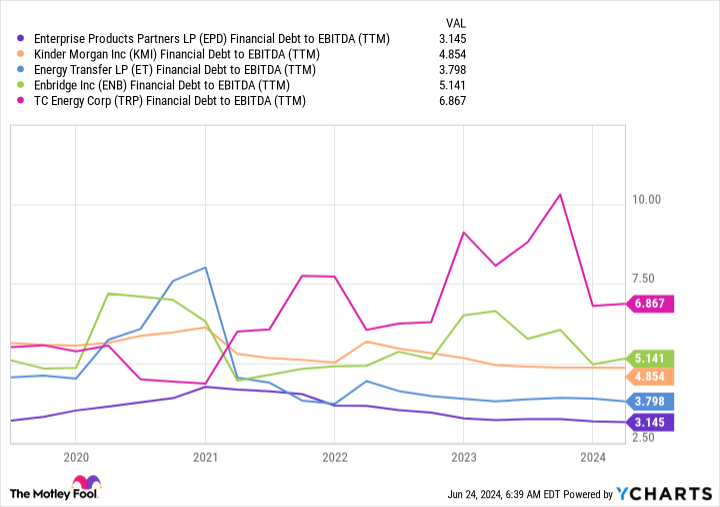

For starters, the stability sheet is rated funding grade. It maintained its leverage on the low finish of its friends. Its debt-to-EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization) ratio, a key leverage metric within the midstream house, has been an business finest for a while.

And, extra to the purpose, the corporate’s distributable money circulation covers its distribution 1.7 occasions over. There’s a variety of room for adversity right here earlier than that distribution could be prone to being reduce.

An excellent possibility for earnings buyers

There are at all times trade-offs in relation to investing. With Enterprise, the largest one goes to be low development.

But when your purpose is producing a dependable passive earnings stream, then you’ll most likely take a look at Enterprise and need to purchase it like there is not any tomorrow. In fact, you should not personal solely Enterprise, and it needs to be seen as one half of a bigger, diversified portfolio. However it’s, actually, each bit nearly as good because it appears in case you are looking for dependable earnings shares.

Must you make investments $1,000 in Enterprise Merchandise Companions proper now?

Before you purchase inventory in Enterprise Merchandise Companions, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Enterprise Merchandise Companions wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $757,001!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a disclosure coverage.

3 Causes to Purchase Enterprise Merchandise Companions Like There’s No Tomorrow was initially revealed by The Motley Idiot