For greater than a century, Wall Avenue has been a wealth-building machine. Right this moment, buyers have hundreds of publicly traded firms and exchange-traded funds to select from when placing their cash to work.

However among the many numerous methods that may be deployed to develop your nest egg on Wall Avenue, few have been extra profitable over the past half-century than shopping for and holding high-quality dividend shares.

In current weeks, the analysts at Hartford Funds refreshed a large number of information units that have been revealed in a report (“The Energy of Dividends: Previous, Current, and Future”) launched final yr in collaboration with Ned Davis Analysis. Particularly, the duo examined the common annual returns of dividend payers versus non-payers over the past half-century (1973-2023), in addition to in contrast how unstable earnings shares have been relative to non-payers.

Hartford Funds discovered that publicly traded firms with no dividend generated a modest common annual return of 4.27% over 50 years and have been 18% extra unstable than the benchmark S&P 500. Alternatively, dividend payers greater than doubled the common annual return of non-payers (9.17%), and did so whereas being 6% much less unstable than the broadly adopted S&P 500.

One sector that is recognized for its juicy dividends is vitality. The vitality sector encompasses oil and fuel (O&G) drilling, midstream, and refining firms, O&G gear suppliers, and a handful of coal and uranium producers.

Out of the practically 200 vitality shares with a market cap of at the least $300 million, 50 help an ultra-high-yield dividend — i.e., one which’s at the least 4 instances greater than yield of the S&P 500. Amongst these 50 high-octane vitality earnings shares are two traditionally low-cost firms with a mean yield of 9.87% which can be begging to be purchased proper now by opportunistic buyers.

Time to pounce: Enterprise Merchandise Companions (7.27% yield)

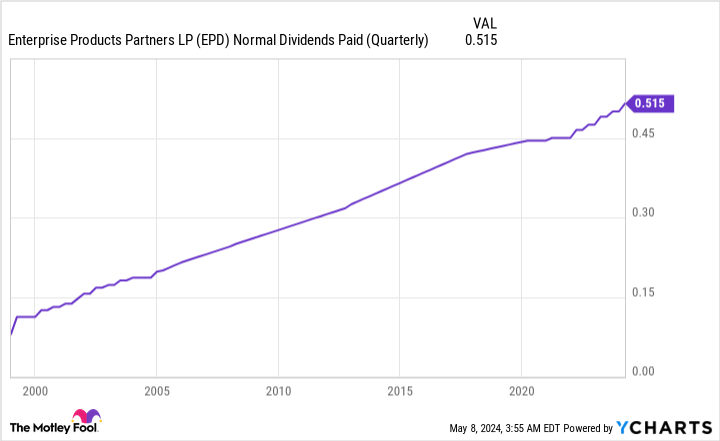

The primary supercharged vitality dividend inventory that ought to have buyers able to pounce is none apart from Enterprise Merchandise Companions (NYSE: EPD). Enterprise sports activities a market-topping 7.3% yield and has elevated its base annual distribution in every of the previous 25 years.

For some buyers, the thought of placing their cash to work in O&G shares is worrisome given what occurred to vitality commodities 4 years in the past. In April 2020, through the early levels of the COVID-19 pandemic lockdowns, crude oil futures briefly plunged to adverse $40 per barrel.

Nonetheless, Enterprise Merchandise Companions was in a position to keep away from this working roller-coaster. That is as a result of it isn’t a driller. It is certainly one of America’s largest midstream O&G firms.

Midstream firms are greatest considered vitality middlemen. They contract with upstream (drilling) vitality firms and deal with the transmission and storage of oil, pure fuel, pure fuel liquids, and refined merchandise. Enterprise oversees greater than 50,000 miles of transmission pipeline and may retailer in extra of 300 million barrels of liquids and 14 billion cubic ft of pure fuel.

Enterprise Merchandise Companions’ “secret sauce” is its contracts. It negotiates long-term offers with upstream vitality firms which can be predominantly fixed-fee. Mounted-fee contracts take away the consequences of inflation and spot-price volatility from the equation, which results in extremely predictable working money move yr after yr.

With the ability to precisely forecast its working money move is vitally necessary in the case of outlaying capital for bolt-on acquisitions and new initiatives. The corporate’s administration staff has allotted roughly $6.9 billion to main initiatives, lots of that are centered on increasing its pure fuel liquids capability. These initiatives ought to incrementally carry working money move over time.

I am going to additionally add that the corporate’s clear and predictable money move ensured that its distribution was by no means at risk of being lowered or halted through the peak of the pandemic. Whereas a distribution protection ratio (DCR) — the quantity of distributable money introduced in by an organization divided by what it pays out to its buyers — of 1 or beneath would sign an unsustainable payout, Enterprise’s DCR by no means fell beneath 1.6 through the pandemic.

Macroeconomic catalysts can gasoline progress for Enterprise Merchandise Companions, as effectively. A number of years of lowered capital spending by main vitality firms through the pandemic has constrained the worldwide provide of oil. So long as provide stays tight, the spot worth of crude oil ought to be elevated. In different phrases, it is prone to encourage home drillers to spice up their manufacturing, which in flip may help Enterprise safe extra profitable, long-term, fixed-fee contracts.

Enterprise Merchandise Companions appears to be like significantly low-cost at a a number of of roughly 7 instances estimated money move for 2025.

Time to pounce: Alliance Useful resource Companions (12.46% yield)

The opposite traditionally low-cost ultra-high-yield vitality inventory that is begging to be purchased proper now’s coal firm Alliance Useful resource Companions (NASDAQ: ARLP). Though Alliance Useful resource did succumb to the pressures of a historic demand cliff for vitality commodities through the early levels of the pandemic, it has since reintroduced and considerably grown its quarterly distribution. In the mean time, it is digging up a 12.5% yield for its buyers.

The plain concern for coal shares is that they are yesterday’s information. Getting into this decade, it was broadly anticipated that utilities and companies would aggressively spend money on clean-energy options, comparable to wind and solar energy, which would go away the coal business to slowly wither away. Nonetheless, the pandemic modified every part.

With world vitality firms having in the reduction of on their capital expenditures, the business that was in a position to step as much as the plate and choose up the slack has been coal. Alliance Useful resource and its friends have loved a resurgence of coal demand, in addition to a traditionally excessive per-ton sale worth.

The Federal Reserve’s hawkish financial coverage has additionally, inadvertently, been a optimistic for Alliance Useful resource Companions. Endeavor clean-energy initiatives prices some huge cash. With rates of interest rising at their quickest tempo in 4 a long time, the return on funding for photo voltaic and wind initiatives is not as compelling.

Alternatively, Alliance Useful resource Companions’ administration staff has achieved a superb job of conservatively increasing manufacturing whereas preserving debt-servicing prices manageable. The corporate closed out the March quarter with $297.1 million in web debt, and generated near $210 million in web money from its working actions. A better rate of interest surroundings is not a lot of a priority for Alliance Useful resource.

The corporate’s administration staff additionally deserves credit score for the way it’s producing predictable money move yr in and yr out. The not-so-subtle trick has been a willingness to cost and commit manufacturing as much as 4 years upfront. Based mostly on a midpoint of 34.9 million tons of anticipated coal manufacturing in 2024, the corporate has 32.6 million tons already priced and dedicated this yr, together with 16.3 million tons subsequent yr. Locking these commitments in with per-ton costs effectively above their historic norm is a genius transfer that is led to clear money move era.

One thing else to notice about Alliance Useful resource Companions is that it is diversified its operations by buying O&G royalty pursuits. Put merely, if the spot worth of crude oil or pure fuel rises, there is a actually good likelihood the corporate’s earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) will climb, too.

Lastly, the valuation makes quite a lot of sense. A forward-year earnings a number of of 6 is a reasonable worth to pay for a premier coal firm that is firing on all cylinders.

Must you make investments $1,000 in Enterprise Merchandise Companions proper now?

Before you purchase inventory in Enterprise Merchandise Companions, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Enterprise Merchandise Companions wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $554,830!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 6, 2024

Sean Williams has no place in any of the shares talked about. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a disclosure coverage.

Time to Pounce: 2 Traditionally Low cost Extremely-Excessive-Yield Power Shares That Are Begging to Be Purchased Proper Now was initially revealed by The Motley Idiot