Superior Micro Gadgets (NASDAQ: AMD) has a potent position in tech, supplying its chips to corporations throughout the business. Its {hardware} powers all the pieces, from online game consoles to cloud platforms, consumer-built private computer systems, laptops, and AI fashions. Because of this, AMD shaped profitable partnerships with corporations like Microsoft (NASDAQ: MSFT), Sony, and Meta Platforms.

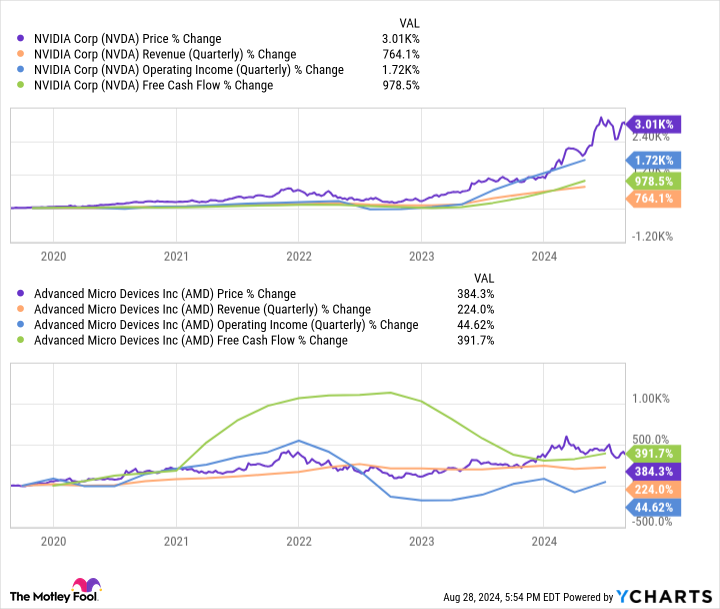

AMD’s success over time noticed its income and working earnings improve by 224% and 45%, comparatively, since 2019. In the meantime, its inventory climbed by 384% within the final 5 years. The corporate boasts an extended progress historical past and has a stable outlook because it expands into high-growth sectors like AI.

Nonetheless, a rally over the past yr and a enterprise that has solely just lately begun seeing returns on its vital funding in AI means its inventory is not precisely a discount.

When you think about the price-to-earnings (P/E) ratios of a number of the most distinguished names in AI, together with three chipmakers and two main cloud suppliers, AMD has the very best P/E amongst these corporations, indicating its inventory presents the least worth.

AMD’s P/E would possibly show inconsequential over the long run, as the corporate’s inventory will seemingly proceed rising because the tech business expands. Nonetheless, for anybody on the lookout for bargains, it is likely to be finest to keep away from AMD for now.

So, neglect AMD this month and contemplate shopping for these two tech shares as an alternative.

1. Nvidia

Nvidia (NASDAQ: NVDA) is not a screaming worth with a P/E of 74. Nonetheless, its inventory stays a compelling choice with a decrease P/E than its rivals, AMD and Intel, and a majority market share in AI.

Chip shares are among the finest methods to spend money on tech, with their {hardware} essential to the business’s growth. Advances in chip know-how bolstered numerous markets over the past decade, encouraging innovation in cloud computing, digital/augmented actuality, knowledge facilities, shopper tech, gaming, and extra. Because of this, chip demand has skyrocketed lately.

As main chipmakers, Nvidia and AMD loved stable beneficial properties over the past half-decade because of elevated chip gross sales. Whereas each corporations have delivered stellar progress, it is exhausting to disregard how a lot larger Nvidia’s earnings and share value have risen in comparison with AMD’s. Nvidia’s has additionally confirmed to be extra dependable, with its earnings and inventory steadily trending up, whereas AMD skilled extra volatility.

Nvidia’s success is especially on account of its dominance in graphics processing items (GPUs), that are high-performance chips able to finishing a number of duties concurrently. GPUs are vital for coaching AI fashions and powering knowledge facilities. Consequently, the AI chip market is projected to hit $71 billion this yr, with Nvidia’s {hardware} accounting for an estimated 90% of the business.

Nvidia has a stable position in tech, and its enterprise will seemingly proceed increasing as demand for its chips rises. This yr, the corporate reached $39 billion in free money movement, considerably outperforming AMD’s simply over $1 billion. Nvidia has the monetary sources to proceed investing in AI and keep its lead. In the meantime, its better-valued inventory makes it a no brainer proper now.

2. Microsoft

When investing in tech, it is a good suggestion to diversify your holdings in software program and {hardware}. Whereas Nvidia is a wonderful choice for securing a place within the {hardware} aspect of the business, Microsoft has years of expertise dominating software program. Residence-grown merchandise like Home windows, Workplace, Xbox, Azure, and LinkedIn have helped the corporate construct a large person base and a strong position in tech.

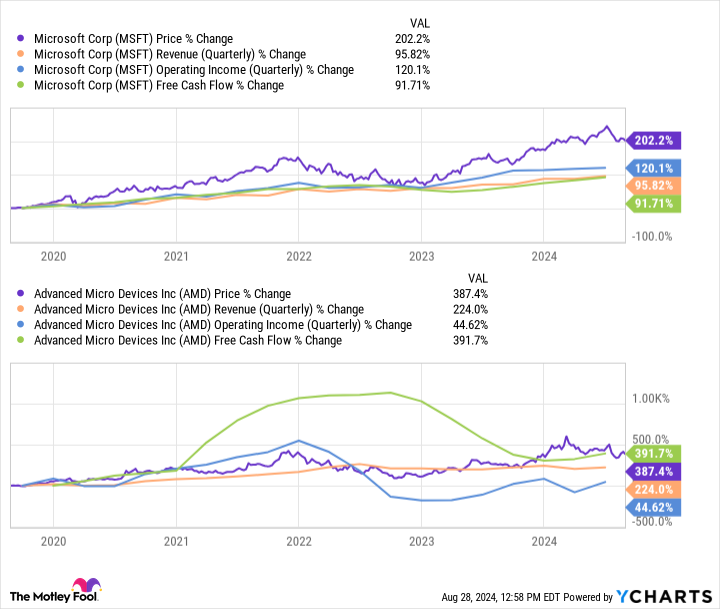

Since 2019, Microsoft delivered much less earnings and share value progress than AMD. Nonetheless, like Nvidia, Microsoft has been way more constant, making it a much less dangerous funding. Because of this, the corporate’s inventory is doubtlessly a greater long-term maintain.

Microsoft’s reliability is especially on account of its completely numerous enterprise mannequin. The corporate has main positions in a number of tech areas, from productiveness software program to working techniques, video video games, social media, cloud computing, and digital promoting.

Furthermore, Microsoft isn’t nonetheless for lengthy, persistently reinvesting in its enterprise and looking for out new progress markets. The corporate’s dedication to innovation noticed it change into an early investor in AI, sinking $1 billion into ChatGPT developer OpenAI in 2019. That determine has since risen to about $13 billion, with the highly effective partnership giving Microsoft entry to a number of the most superior AI software program.

In the meantime, Microsoft has already begun seeing earnings boosts from AI, because of just lately launched AI options on its cloud platform, Azure, and paid-for options in Workplace. In fiscal 2024 (ending in June), Microsoft’s income elevated by 16% yr over yr, whereas working earnings soared 24%. The interval benefited from a 20% rise in cloud gross sales and a 12% improve in its productiveness and enterprise processes phase, with each divisions increasing their AI choices.

Microsoft’s numerous enterprise gives it with numerous methods to monetize its AI enterprise. Alongside $74 billion in free money movement and a better-valued inventory, it is value choosing up Microsoft over AMD this August.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $720,542!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Cook dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief November 2024 $24 calls on Intel. The Motley Idiot has a disclosure coverage.

Overlook AMD: 2 Tech Shares to Purchase As a substitute was initially revealed by The Motley Idiot