The inventory market has fluctuated and reshuffled rather a lot for the reason that begin of final 12 months. A surge in synthetic intelligence (AI) has make clear the huge potential of tech shares, rallying traders and boosting the Nasdaq Composite by greater than 60% since Jan. 1, 2023.

Apple (NASDAQ: AAPL) secured its place because the world’s most useful firm by market cap in 2011 and held that spot constantly till this 12 months. The tech large quickly misplaced the highest place between January and June of 2024 when Microsoft (NASDAQ: MSFT) surpassed Apple, and Nvidia (NASDAQ: NVDA) briefly achieved a market cap above $3 trillion.

Nonetheless, Apple’s market cap of $3.3 trillion has seen it as soon as once more develop into the world’s most useful firm. But, Microsoft and Nvidia proceed to nip at its heels and will overtake the corporate for good within the coming years.

Microsoft’s diversified enterprise mannequin and more and more established place in AI point out it may have a extra dependable place in tech. In the meantime, Nvidia’s practically unequalled dominance within the chip market seems to be the present that retains on giving as demand for graphics processing items (GPUs) continues to soar.

So, listed below are two shares that I predict might be value greater than Apple 5 years from now.

1. Nvidia

Nvidia’s market cap was $360 billion at first of 2023 and is now $2.6 trillion, delivering a formidable progress spurt.

The corporate has constantly outperformed Apple in inventory progress during the last 5 years, with its share worth up 2,600% in comparison with the iPhone maker’s 330% rise. And that development is unlikely to sluggish anytime quickly.

This chart reveals the large distinction in monetary progress Nvidia and Apple have skilled over simply the final 12 months. Whereas these firms are each leaders in tech, their companies differ considerably.

Nvidia is taking advantage of hovering demand for chips, particularly its GPUs. These chips energy many merchandise, from cloud platforms to AI fashions, private computer systems, recreation improvement engines, and extra. In the meantime, Nvidia has achieved an estimated 70% to 95% market share in GPUs.

Technological advances are solely prone to proceed rising the demand for highly effective chips as firms work to enhance their {hardware} and software program choices. Conversely, Apple has struggled to draw new prospects to its merchandise during the last 12 months, with its iPhone and Mac income down 10% and eight%, respectively.

Apple is working to increase in AI and can launch a significant software program replace this fall referred to as Apple Intelligence. The replace will overhaul its working programs, introducing varied generative options. The corporate hopes Apple Intelligence will persuade hundreds of thousands of customers to improve their units, because the options will solely be accessible with newer merchandise. Whereas the software program may increase earnings for the present fiscal 12 months, how Apple will revenue from AI over the long run stays to be seen.

In the meantime, Nvidia maintains a vital function within the trade as a number one chipmaker, a place that can probably see it surpass Apple by market cap over the following 5 years.

2. Microsoft

For years, Microsoft has performed second fiddle to Apple on the record of most useful firms. Apple has constantly outperformed the Home windows firm in inventory progress, rising 330% since 2019 in comparison with Microsoft’s 195%.

Nonetheless, that development has shifted in 2024. Microsoft’s share worth is up 12% 12 months to this point, with Apple’s up 8%. It is not an enormous distinction, however Microsoft’s head begin in AI and potent place in software program will probably see it proceed to outperform its rival.

The AI market is projected to increase at a compound annual progress price of 37% by means of 2030, which might see it hit practically $2 trillion in spending. In the meantime, Microsoft’s numerous enterprise mannequin grants it a number of methods to monetize its AI merchandise, because of homegrown manufacturers like Home windows, Workplace, Azure, Bing, Xbox, and LinkedIn.

Because the begin of 2023, the corporate has launched generative options throughout its product lineup. This consists of new productiveness instruments on Home windows and its Workplace productiveness suite, a revamp of Bing, and a number of AI options on its cloud platform Azure. Microsoft has additionally begun recouping a few of its hefty funding in AI, attracting new members to Azure and Microsoft 365. Their respective segments have loved year-over-year gross sales rises of 12% and 20% in 2024.

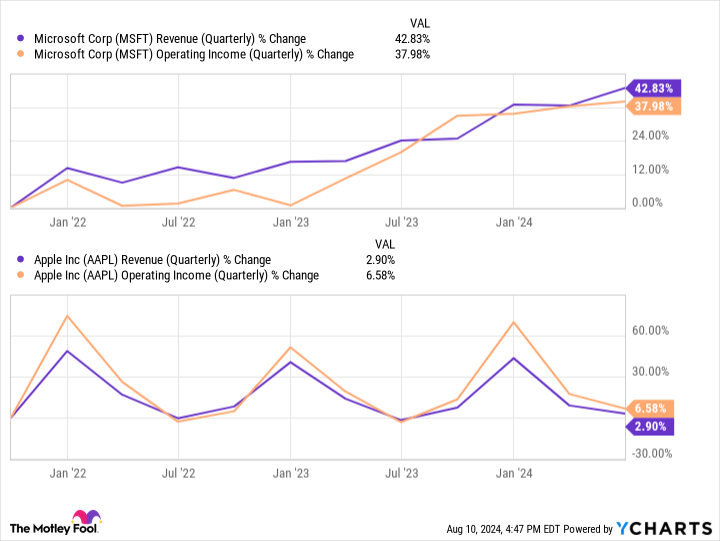

Like Nvidia, Microsoft is outperforming Apple in earnings progress. Over the past three years, Microsoft’s quarterly income and working revenue have risen far larger than Apple’s.

Microsoft turned a behemoth in tech because of its success in software program. The emergence of AI has given it the chance for its distinctive ability set and product vary to shine. The corporate arguably has extra progress potential in AI, which may permit it to overhaul Apple in market worth earlier than the tip of the last decade.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $711,657!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Prediction: 2 Shares That Will Be Value Extra Than Apple 5 Years From Now was initially printed by The Motley Idiot