One of many biggest elements about placing your cash to work on Wall Road is there are numerous methods to develop your wealth. No matter your threat tolerance or funding focus, there are literally thousands of particular person firms and/or exchange-traded funds (ETFs) that may meet your standards.

However amongst this countless sea of attainable funding methods, one tends to rise above the pack. I am speaking about shopping for high-quality dividend shares and hanging onto these positions over an prolonged timeline.

Just lately, the analysts at Hartford Funds, in collaboration with Ned Davis Analysis, up to date their information units from an intensive examine on dividend shares that was launched final 12 months (“The Energy of Dividends: Previous, Current, and Future”). This duo in contrast the efficiency and volatility of dividend-paying shares to non-payers over a half century (1973-2023).

Following the latest replace, Hartford Funds discovered that non-paying public firms averaged a 4.27% annual return over the prior half-century, and had been 18% extra unstable than the benchmark S&P 500. By comparability, dividend payers delivered a 9.17% common annual return over the prior 50 years, and did so whereas being 6% much less unstable than the S&P 500.

Firms which are commonly sharing a share of their income with traders are typically worthwhile on a recurring foundation and are sometimes in a position to present clear long-term progress outlooks. Briefly, these are companies we might count on to rise in worth over time and make their affected person shareholders richer.

However not all dividend shares are created equally. Though some ultra-high-yield shares — “ultra-high-yield” within the sense that their yields are at the least 4 instances greater than the S&P 500 — are extra hassle than they’re value, choose high-octane revenue shares could be true gems.

What follows are two beaten-down ultra-high-yield dividend shares — with a median yield of seven.57% — which are traditionally low-cost and ripe for the choosing by opportunistic revenue seekers.

AT&T: 6.43% yield

The primary supercharged dividend inventory that is exceptionally low-cost and begging to be purchased proper now could be telecom titan AT&T (NYSE: T). Although AT&T’s dividend has remained static at $0.2775 per quarter, its yield is a protected and hearty 6.4%!

However despite this phenomenal payout, AT&T’s inventory has fallen by 42% since late 2019.

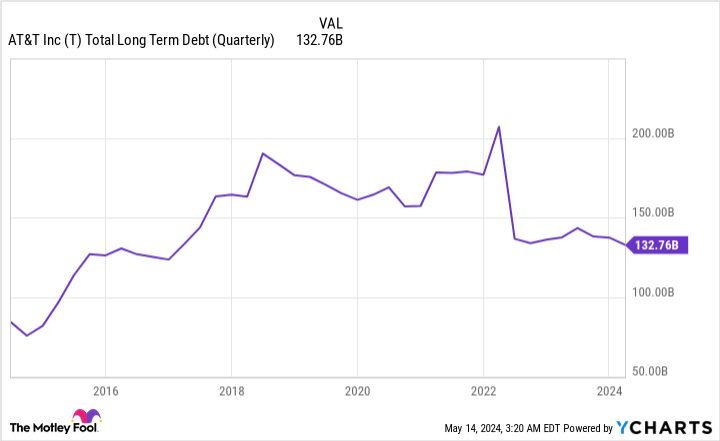

One of many causes for this weak point is rising rates of interest. The corporate closed out the March quarter with $132.8 billion in whole debt. Lugging round a large quantity of debt is fairly frequent for legacy telecom firms. Sadly, with the Fed aggressively elevating charges to fight traditionally excessive inflation, any future refinance exercise and/or deal-making may very well be notably costlier to AT&T.

The opposite concern for AT&T has to do with a narrative from The Wall Road Journal launched in July 2023. The WSJ report alleges that legacy telecom firms might face hefty cleanup and environmental/health-related prices tied to their use of lead-sheathed cables. With a lot debt already on their stability sheets, the very last thing telecom firms want is a possible multibillion-dollar legal responsibility.

Whereas these are tangible headwinds that present and potential AT&T traders should not sweep below the rug, it is essential to acknowledge that neither are as regarding as the corporate’s beaten-down share worth would counsel.

Though AT&T’s $132.8 billion in whole debt is daunting, the corporate’s monetary scenario has dramatically improved during the last two years. When AT&T divested WarnerMedia in April 2022, and it subsequently merged with Discovery to create a brand new media entity, Warner Bros. Discovery, AT&T loved greater than $40 billion in concessions — e.g., Warner Bros. Discovery taking over choose plenty of debt beforehand held by AT&T. Over the past two years (ended March 31, 2024), the corporate’s web debt has declined from $169 billion to $128.7 billion.

As for the WSJ report, AT&T has immediately refuted claims that its lead-clad cables current a well being hazard. Additional, legal responsibility claims are usually dealt with within the U.S. court docket system. If AT&T had been to ever face cleanup or legal responsibility prices related to these lead-sheathed cables, it will take years for the court docket to return to a verdict. Over that point, its stability sheet would doubtless enhance.

Other than a firmer stability sheet, AT&T’s core operations proceed to learn from the 5G revolution. Wi-fi service income is on tempo to extend by 3% in 2024, with churn charges remaining close to a document low.

In the meantime, AT&T’s broadband phase received off to a different robust begin within the new 12 months with the online addition of 252,000 AT&T Fiber subscribers. The corporate has added at the least 1 million web broadband clients for six consecutive years.

Although AT&T’s working mannequin is not flashy, and its progress heyday ended a long time in the past, it is able to delivering mid-single-digit gross sales and earnings progress, together with predictable working money circulation. Valued at simply 7.5 instances consensus earnings per share (EPS) in 2025, AT&T is an plain cut price.

Altria Group: 8.7% yield

The second beaten-down ultra-high-yield dividend inventory that is traditionally low-cost and begging to be purchased proper now could be tobacco large Altria Group (NYSE: MO). Altria has raised its payout 58 instances over the previous 54 years, which locations it in elite firm amongst a handful of different “Dividend Kings.”

The clear-cut problem for tobacco shares is that customers have turn into extra knowledgeable concerning the potential long-term well being hazards of utilizing tobacco merchandise. Within the U.S., which is Altria’s area, the share of adults who smoke cigarettes has declined from round 42% within the mid-Nineteen Sixties to only 11.5%, as of 2021. A steadily shrinking pool of sufferers is a worrisome scenario for any firm.

Moreover, Altria’s high-growth days are actually nicely within the rearview mirror. With rates of interest held close to historic lows for a lot of the last decade previous to 2022, traders flocked to faster-growing firms. This meant mature companies like Altria slowly grew to become the inventory market’s equal of chopped liver. Not surprisingly, shares have fallen by 42% since peaking in 2017.

Whereas sin shares like Altria Group aren’t going to be each investor’s cup of tea, it is nonetheless an organization that possesses catalysts that may nonetheless ship rock-solid returns to affected person traders.

One issue that continues to learn Altria is its pricing energy. As a result of nicotine is an addictive chemical, the corporate usually has little hassle passing alongside worth hikes that may partially or totally offset any decline in cigarette shipments.

So as to add to the above, it actually would not damage that Altria is a market share juggernaut in the USA. The corporate’s premium Marlboro model accounted for a 42% share of the U.S. cigarette market within the first quarter, whereas its different premium and low cost manufacturers tacked on one other 4.4% in collective market share. Controlling almost half of U.S. cigarette market share makes it even simpler for Altria to boost costs on its clients.

Nonetheless, Altria’s recreation plan entails extra than simply worth hikes. Administration goals to introduce new gross sales channels that may reignite the corporate’s progress engine.

For example, Altria acquired electronic-vapor firm NJOY Holdings in June 2023 for $2.75 billion. Whereas Altria’s sizable funding in e-vape firm Juul did not pan out, shopping for NJOY was a no brainer due to a clear-cut differentiating issue.

On the time the buyout was accomplished, NJOY had acquired a half-dozen advertising granted orders (MGOs) from the U.S. Meals and Drug Administration (FDA). These MGOs are successfully permission slips from the FDA that enable e-vape merchandise to stay on retail cabinets. The overwhelming majority of e-vapor merchandise lack MGOs, and will due to this fact be pulled at any second.

Moreover, Altria is a longtime fairness stakeholder in Canadian marijuana licensed producer Cronos Group. Just lately, the U.S. federal authorities introduced that hashish would quickly be rescheduled to a less-stringent classification of a managed substance. This may occasionally open the door for Canadian medical marijuana producers to enter the U.S. market.

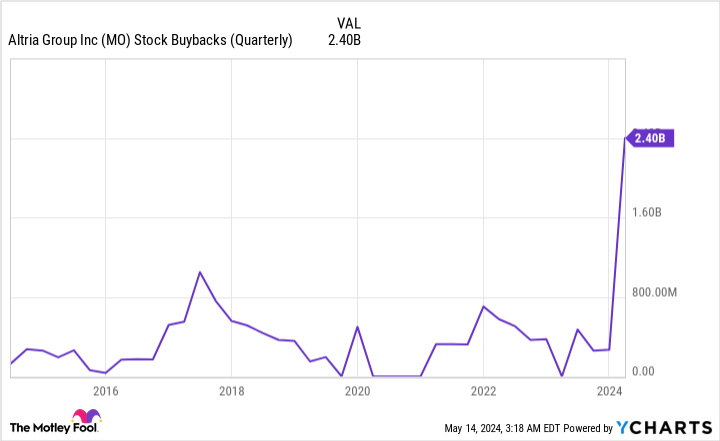

Lastly, Altria Group has a stellar capital-return program. The corporate’s board licensed a $2.4 billion accelerated share repurchase program, and plans to finish a further $1 billion in buybacks earlier than the top of this 12 months.

A ahead price-to-earnings ratio of 8.5, coupled with a yield of 8.7%, is extremely engaging for revenue seekers.

Must you make investments $1,000 in AT&T proper now?

Before you purchase inventory in AT&T, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and AT&T wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $559,743!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 13, 2024

Sean Williams has positions in AT&T and Warner Bros. Discovery. The Motley Idiot has positions in and recommends Warner Bros. Discovery. The Motley Idiot has a disclosure coverage.

Time to Pounce: 2 Overwhelmed-Down Extremely-Excessive-Yield Dividend Shares That Are Traditionally Low-cost and Begging to Be Purchased Proper Now was initially printed by The Motley Idiot