Because the flip of the century, Nike (NYSE: NKE) and Pool Company (NASDAQ: POOL) have delivered market-trouncing whole returns of 1,560% and seven,790%, respectively. Nonetheless, these historically strong companies have seen their share costs decline 47% and 59% over the previous few years. Going through an array of shorter-term macroeconomic points, akin to softer shopper spending, persistent inflation, and increased rates of interest, these shares have seen the market dismiss their longer-term potential.

Though each firms face very actual challenges, these look to be momentary — and the shares at the moment are accessible at once-in-a-decade valuations. Right here is why this short-term volatility may show to be a powerful alternative for affected person traders who assume in many years, not quarters.

1. Nike

There isn’t any operating from it — proudly owning shares of Nike has been a tough journey over the previous few years. With its share value down 59% from its all-time highs, Nike is at the moment experiencing the third-largest drawdown in its historical past.

Solely rising gross sales by 1% in 2024 and guiding for a mid-single-digit income decline for 2025, the corporate was unable to assuage the market’s fears, resulting in a brand new 15% drop in a single day in June.

So what precisely makes Nike a once-in-a-decade alternative at this time and all through the second half of 2024? First, from a monetary standpoint, the corporate’s stock and days stock excellent proceed to inch decrease towards historic norms.

Whereas this alone does not imply a turnaround is instantly forthcoming, regular stock ranges assist release Nike to get again to its progressive roots and create the subsequent era of well-liked attire for its devoted clients.

My second level focuses on these devoted clients. Regardless of the short-term challenges confronted by Nike, it stays far and away essentially the most highly effective model within the attire business. Ranked twenty first on Kantar BrandZ’s listing of The Prime 100 Most Beneficial World Manufacturers, Nike continues to carry immense mindshare amongst customers. Firms included on Kantar’s listing have outperformed the S&P 500 since 2003, delivering whole returns of 321% versus the index’s 231%.

Moreover, a latest research by Piper Sandler of prime manufacturers in line with Gen Z consumers exhibits that Nike dominates each the clothes and footwear classes, with 34% and 59% of customers naming Nike the highest model in every area of interest. In each classes, the second- by fifth-highest manufacturers mixed to account for lower than half of Nike’s share.

So, whereas Nike’s ongoing turnaround might have time to develop, this younger group of consumers highlights that the corporate’s future stays extremely vibrant. Buying and selling with a price-to-earnings (P/E) ratio of 20 that’s at 10-year lows and a 1.9% dividend that’s its highest for the reason that Nice Recession, Nike might be a contrarian choose for long-term traders proper now.

That mentioned, issues may proceed to worsen earlier than they get higher for Nike, so dollar-cost averaging (DCA) purchases make extra sense than going all-in at at this time’s value.

2. Poolcorp

Pool Company — higher often called Poolcorp — is the most important U.S. distributor of pool provides. Its shares have declined 47% since 2022 as customers proceed to rein in spending. With the Expectations Index — a element of the Client Confidence Index — recording its fifth-straight quarter of a rating beneath 80, this slowdown in shopper spending can clearly be seen.

Sometimes, a rating beneath 100 exhibits that customers are pessimistic concerning the future economic system, inflicting them to be extra cautious with their spending, particularly on big-ticket objects like new or refurbished swimming pools. Hindered by this pessimism, paired with homebuyers battling persistent inflation and better rates of interest, Poolcorp felt the affect.

Within the firm’s most up-to-date quarter, gross sales and earnings per share (EPS) declined by 7% and 21%, respectively, as new residence and pool builds remained depressed. Nonetheless, in comparison with the severity of an Expertise Index of solely 73 — a rating sometimes reserved for recessionary instances — these outcomes are removed from disastrous.

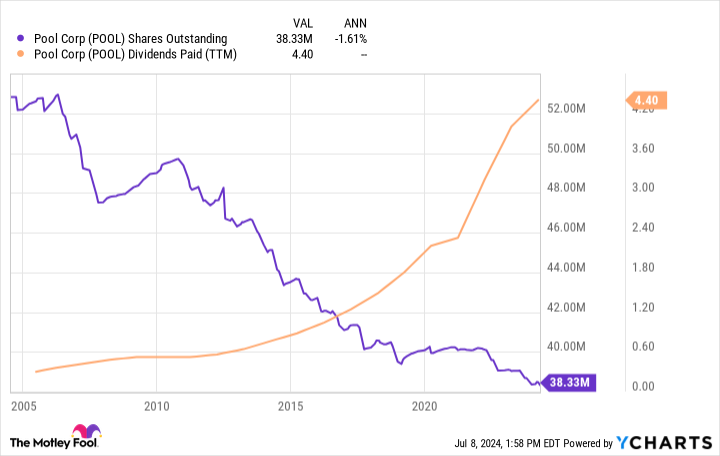

Producing 86% of its gross sales from non-discretionary, recurring objects like upkeep (akin to pool chemical compounds), Poolcorp demonstrates resilience in difficult instances, as evidenced by the corporate’s steady profitability all through the 2008 recession. Additional highlighting this resilience, Pool has an extended monitor document of steadily decreasing its share depend whereas rising its dividend for 13 straight years regardless of being tied to the cyclical housing business.

As the corporate continues to increase into higher-margin alternatives, akin to its franchised Pinch-a-Penny retail shops and private-label pool chemical compounds, these money returns to shareholders ought to proceed rising. Greatest but for traders, Pool could also be buying and selling at a once-in-a-decade valuation.

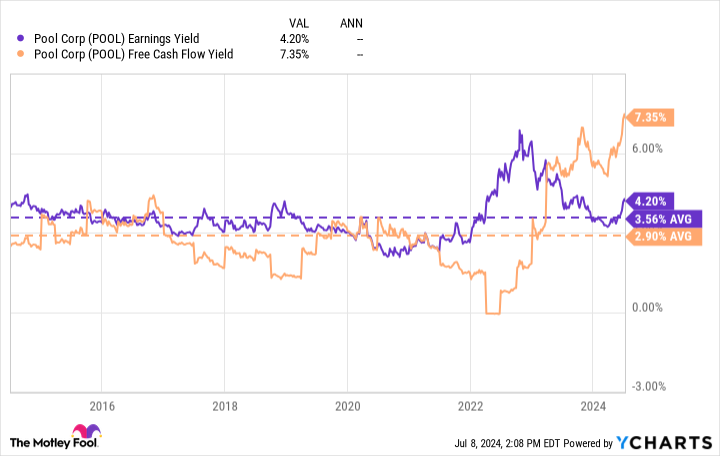

Whether or not utilizing the corporate’s earnings yield or free-cash-flow (FCF) yield (that are the inverse of the price-to-earnings ratio and price-to-FCF ratios, so increased is “cheaper”), Poolcorp trades at a deep low cost to its 10-year averages.

The cherry on prime for traders? Poolcorp’s 1.5% dividend yield is the very best it has been since 2014, and it nonetheless solely accounts for roughly one-third of the corporate’s whole internet revenue.

Nonetheless, very like Nike, potential Poolcorp traders could need to use DCA purchases on the corporate because it waits for a broader turnaround in shopper and homebuying confidence.

Do you have to make investments $1,000 in Nike proper now?

Before you purchase inventory in Nike, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nike wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $826,672!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

Josh Kohn-Lindquist has positions in Nike and Pool. The Motley Idiot has positions in and recommends Nike. The Motley Idiot recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.

A As soon as-in-a-Decade Alternative: 2 Magnificent S&P 500 Dividend Shares Down 47% and 59% to Purchase within the Second Half of 2024 was initially revealed by The Motley Idiot