The tech business is booming, bolstered by advances in sectors like synthetic intelligence (AI), cloud computing, chip design, digital/augmented actuality (VR/AR), and rather more. Due to its seemingly ever-expanding nature, tech has repeatedly confirmed to be among the best markets to put money into over the long run.

Lots of the business’s largest gamers have reputations for delivering vital positive factors over a few years, confirmed by the Nasdaq-100 expertise sector’s rise of 390% over the past decade. It is subsequently not stunning that Berkshire Hathaway, led by funding mogul Warren Buffett, has devoted greater than 40% of its portfolio to tech shares.

It is by no means too late to put money into tech, with no higher time to start out than now. Listed below are two prime tech shares to purchase in June.

1. Intel

You is perhaps stunned to see Intel (NASDAQ: INTC) on this checklist after a difficult few years for the corporate. It is no secret that the chipmaker’s enterprise has lately confronted quite a lot of hardships. Intel was as soon as a king within the chip market, with greater than 80% market share in central processing models (CPU) in 2017 and a profitable partnership with Apple (NASDAQ: AAPL) as its main chip provider.

Nonetheless, a lot has modified for the corporate. Elevated competitors has led its place within the CPU market to fall to 64%, and the take care of Apple resulted in 2020. In the meantime, a shift within the chip business has seen CPU demand fall whereas graphics processing unit (GPU) gross sales have soared. The autumn from grace has despatched Intel’s inventory plunging 47% over the past three years.

But generally, the perfect time to put money into an organization is at its low when a restoration seems underway. And that appears to be the case with Intel, making it one of many best-valued tech shares to purchase now and maintain over the long run.

Intel is within the strategy of transitioning right into a foundry mannequin, prioritizing chip manufacturing over design. The transfer will see the corporate open chip vegetation all through the U.S. and set it aside from opponents like Nvidia and AMD, which outsource their manufacturing. Intel could possibly be in for a big enhance to earnings within the coming years as markets like AI proceed to bolster chip demand as a result of it is completely positioned to satisfy the market’s wants.

The above chart exhibits that Intel is probably the best-valued chip inventory this month, with the lowest ahead price-to-earnings ratio (P/E) and price-to-sales ratio among the many three most distinguished chip corporations. Alongside a promising shift in its enterprise mannequin, Intel is a screaming purchase this June and a tech inventory you will not need to miss out on.

2. Apple

Apple has a popularity for reliability. The corporate’s inventory has risen 343% over the past 5 years regardless of the COVID-19 pandemic and an financial downturn in 2022, which precipitated dwindling product gross sales.

Latest hurdles have made some analysts query whether or not we’re witnessing Apple’s downfall. Nonetheless, with the corporate’s $102 billion in free money stream, a booming companies enterprise, and continued dominance in shopper tech, I would not guess towards the iPhone firm over the long run.

As an example, lowering iPhone gross sales in China, Apple’s third-largest market, has been a subject of a lot scrutiny since final yr because the nation’s shoppers have more and more turned to home opponents. Nonetheless, the problem appears to be resolving and leaning in Apple’s favor. On Might 28, Bloomberg reported iPhone gross sales in China soared 52% final month after a sequence of reductions from Apple.

Whereas reductions are sometimes a short-term answer to an issue, Apple’s product connectivity and companies point out current consumers will stay with the corporate. Apple has strategically created an interconnected ecosystem for its merchandise that encourages customers to department out to its many different units after solely buying one.

In the meantime, companies like iCloud, Apple TV+, Music, and even the App Retailer enable the corporate to maintain getting cash, even when shoppers determine to not improve their units. Because of this, the spike in Chinese language gross sales might see Apple stay a menace in China for years.

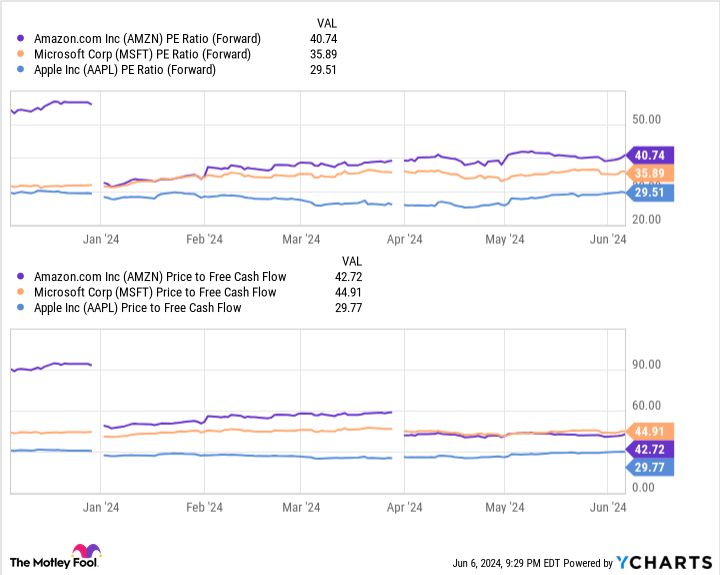

Like Intel, Apple’s inventory is buying and selling at a much better worth than its prime opponents, with a decrease ahead P/E and price-to-free-cash-flow ratio than Microsoft and Amazon. Add to that the corporate’s ventures into high-growth markets like AI and VR/AR, and Apple is a no brainer tech inventory to purchase this month.

Do you have to make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Apple wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $740,688!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 3, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Apple, Berkshire Hathaway, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief August 2024 $35 calls on Intel, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

2 High Tech Shares to Purchase in June was initially revealed by The Motley Idiot