It is a new month and one other nice alternative so as to add dividend earnings to your portfolio. Even because the S&P 500 sits close to all-time highs, there are at all times offers out there. This month, the vitality sector strikes me as notably interesting.

Let’s face it: Excessive-yield dividend shares are sometimes crimson flags. Reliable shares that yield 6%, 7%, and eight% are tough to return by. Excessive yields ceaselessly imply the market has sniffed out bother and is demanding extra earnings to compensate for these dangers.

However there are exceptions. Two high-yield pipeline shares jumped out as table-pounding buys for July. Right here is why you may belief them to ship the products.

A dividend gusher at a good value

Power Switch (NYSE: ET) is essential to North America’s vitality image. The corporate operates an intensive community of storage services and over 125,000 miles of pipelines that transport oil, pure gasoline, and refined merchandise all through the nation.

It connects essential exploration areas, such because the Permian Basin, to ports that ship commodities to over 80 international locations. Pipelines are like toll roads: They generate profits based mostly on the quantity of supplies flowing via their pipes.

Roughly 90% of Power Switch’s earnings come from fee-based contracts, so the enterprise is extra predictable than upstream oil and gasoline corporations that rely upon commodity costs.

Most corporations pay company earnings tax earlier than paying dividends to their shareholders. Then, shareholders should pay taxes on their dividends, which basically means the corporate’s income are taxed twice.

Power Switch is a grasp restricted partnership (MLP), a enterprise construction that does not pay company earnings tax. MLPs are pass-through entities; they distribute their income (MLP for dividend) to unitholders (MLP for shareholder), who pay taxes in response to the variety of models they personal and their particular person earnings tax price. That makes Power Switch extra tax environment friendly, whereas the bigger distributions assist compensate unitholders for carrying the tax burden.

Power Switch’s distribution yields 7.8% and is sustainable as a result of it solely prices simply over half its money circulation.

It is develop into tougher to name the inventory low cost after it has appreciated almost 30% over the previous 12 months. But, regardless of the run, the inventory’s valuation is just barely above its long-term common. Administration is focusing on 3% to five% annual distribution development, which alerts that the enterprise will develop equally.

A mid-single-digit a number of on its working money circulation is affordable for an organization rising at that tempo. Toss within the almost 8% yield, and traders might see annual whole returns between 10% and 13%. That makes Power Switch a possible purchase.

This pipeline large is on sale.

Enbridge (NYSE: ENB) is equally vital to North America’s vitality business. The corporate’s property switch oil, gasoline, and different merchandise all through Canada and america. It helps join the Canadian oil sands to ports all through the continent.

Enbridge’s enterprise additionally contains pure gasoline utilities and renewable vitality manufacturing. That diversification has helped it endure laborious occasions and proceed placing cash in shareholder pockets. The corporate has raised its dividend for 28 consecutive years.

Whereas not a grasp restricted partnership, Enbridge nonetheless gives a beneficiant dividend. The inventory yields 7.5% on the present share value. The corporate’s capacity to boost its dividend via COVID and the monetary disaster in 2008-2009 ought to give traders confidence within the payout.

Enbridge additionally has an investment-grade credit standing and a manageable 66% dividend payout ratio, so the dividend is basically rock-solid.

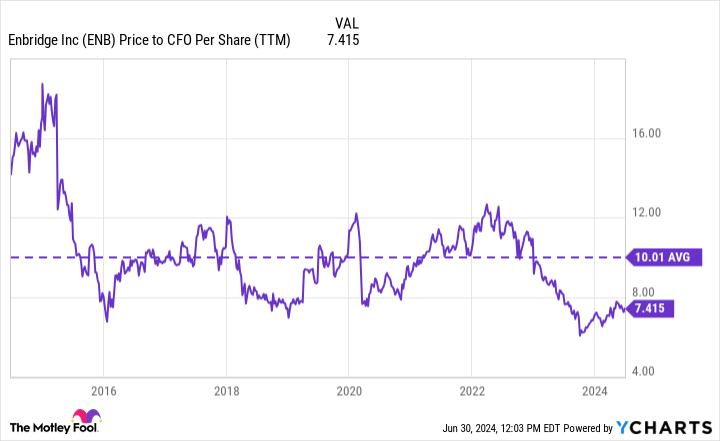

Enbridge inventory hasn’t adopted Power Switch larger; it is down barely over the previous 12 months. The excellent news is that shares stay on sale. Enbridge has traded at a mean of 10 occasions its working money circulation over the previous decade. It trades nicely under that at the moment at 7.4 occasions.

North America figures to stay a key vitality exporter, which ought to hold sufficient flowing via Enbridge’s pipes to drive long-term development. Analysts imagine the corporate’s distributable money circulation will develop by over 6% subsequent 12 months. It appears probably the share value will ultimately comply with. Buyers can acquire a hefty dividend within the meantime.

Must you make investments $1,000 in Power Switch proper now?

Before you purchase inventory in Power Switch, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Power Switch wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $751,670!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Enbridge. The Motley Idiot has a disclosure coverage.

2 Dividend Shares to Purchase Hand Over Fist in July was initially printed by The Motley Idiot