After a lot of massive acquisitions from chip design large Intel in 2015 and one other by AMD in 2022, I’ve written about how small chip design home Lattice Semiconductor (NASDAQ: LSCC) is the final FPGA pure-play firm left standing.

FPGAs (field-programmable gate arrays) are a sort of logic chip. They’ve the flexibility to be reprogrammed utilizing software program to permit engineers to alter the FPGA’s operate — even after the chip has been manufactured and put into use. This makes FPGAs completely different from application-specific built-in circuits (ASICs), and even many CPUs and GPUs, that are designed and pre-programmed to behave a sure method.

Lattice could also be small, but it surely has been quietly profitable a market share battle with its two bigger opponents, Intel and AMD. Because the semiconductor business readies for a brand new development cycle later in 2024, powered by new wants for synthetic intelligence (AI), Lattice may very well be in an distinctive place to maintain profitable.

Monetary numbers paint an attention-grabbing image

When excluding the large knowledge middle AI techniques that Nvidia is producing, a lot of the semiconductor business is definitely nonetheless within the midst of a cyclical droop. Whereas indicators level to the brand new Nvidia- and large tech-fueled bull market thawing out this downturn, maybe in the course of the second half of 2024, Lattice simply launched some disappointing financials for the primary quarter of 2024.

|

Metric |

Q1 2024 |

% Change (YOY) |

|---|---|---|

|

Income |

$141 million |

(24%) |

|

GAAP earnings per share (EPS) |

$0.11 |

(73%) |

|

Free money movement (FCF) |

$26.1 million |

(28%) |

Knowledge supply: Lattice Semiconductor.

These outcomes successfully deliver Lattice’s multi-year spate of development to an finish.

As ugly because the current outcomes could seem, although, Lattice is faring much better than the comparable FPGA segments at Intel and AMD. For Intel, that is primarily Altera, the large FPGA firm it acquired in 2015, and the identify of which it not too long ago resurrected with plans to finally spin it off as a publicly traded firm as soon as extra. And for AMD, that is the “Embedded” income phase, acquired primarily through the megamerger with FPGA market chief Xilinx in early 2022.

Each Intel’s Altera and AMD’s Embedded segments fell by way over Lattice’s FPGA-focused income did to kick off 2024. This implies Lattice is scooping up FPGA chip market share on the expense of its two bigger friends.

|

Firm |

Q1 2024 Income |

YOY % Change |

|---|---|---|

|

Intel Altera |

$846 million |

(46%) |

|

AMD Embedded |

$342 million |

(58%) |

Knowledge supply: Intel and AMD.

Lattice is tiny however mighty

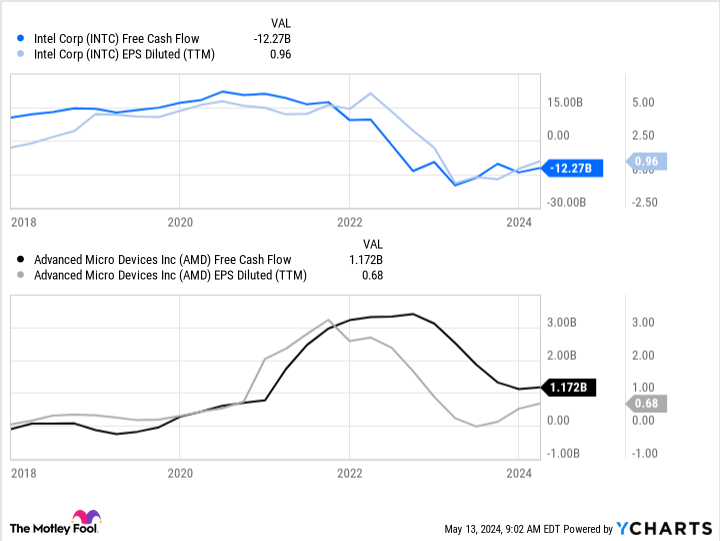

There’s typically large worth in having singular focus as a enterprise, particularly when that singular focus is paired with monetary self-discipline. Whereas Intel and AMD have each struggled to keep up profitability in the course of the chip business downturn within the final year-plus (Intel far more so than AMD), Lattice has remained worthwhile by all counts.

What’s Lattice’s secret? Traditionally, it has targeted on low-end and “small” FPGAs, these with fewer logic cells that may be reprogrammed. These small FPGAs are utilized in issues like industrial gear and sensors, important functions for issues like manufacturing unit automation and for management of many easy performance options in fashionable vehicles.

Lattice has additionally been shifting into mid-sized FPGAs with new product launches in current quarters. These “greater” FPGAs with extra logic blocks are utilized in extra complicated capabilities, like in some components of information facilities, high-end networking and telecom gear, and extra superior self-driving options in vehicles.

In recent times, looking for higher monetary effectivity, each Intel and AMD have sunsetted a few of their small- and mid-sized FPGA product traces. This has left the door open for Lattice to increase its buyer base and promote a broader vary of FPGA chips to current prospects as soon as this present business downtrend is over.

It is not simply Lattice benefiting both. In its newest earnings name, Microchip additionally referred to as out Intel and AMD’s sunsetting of mid-sized FPGAs, an space of the business that Microchip has been making waves in.

The upshot for Lattice

Now, whereas it might make monetary sense for Intel and AMD to try to tighten up their product lineups and cede some share for Lattice, this has a collectively constructive impact for Lattice. Much less competitors means Lattice might promote extra and enhance its revenue margins, too. And, in fact, with all types of AI functions starting to proliferate throughout a number of industries, Lattice small- and mid-sized FPGAs may very well be extra vital than ever earlier than.

The inventory does commerce for a premium of almost 60 instances current-year anticipated EPS. Nonetheless, keep in mind that features the steep falloff in earnings in Q1 and anticipated earnings within the subsequent few quarters as Lattice rallies out of the chip business downturn. I stay a contented shareholder with an eye fixed on this small firm’s potential for larger gross sales and revenue margins for years to come back.

Must you make investments $1,000 in Lattice Semiconductor proper now?

Before you purchase inventory in Lattice Semiconductor, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Lattice Semiconductor wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $559,743!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 13, 2024

Nicholas Rossolillo and his purchasers have positions in Superior Micro Units, Lattice Semiconductor, Microchip Expertise, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick Could 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

1 Small Chip Inventory Outperforming AMD, Intel, and Others in a Essential Space of AI was initially revealed by The Motley Idiot