Synthetic intelligence (AI) is the most popular theme within the expertise realm proper now. Certainly, megacap behemoths such because the “Magnificent Seven” are innovating at light-speed paces and buyers can not seem to get sufficient.

Past the most important of the large tech gamers, quite a few different enterprise software program companies have garnered Wall Avenue’s curiosity. Salesforce.com (NYSE: CRM) makes for one of the vital attention-grabbing case research because it pertains to AI software program.

With shares down roughly 12% 12 months thus far, Salesforce is drastically underperforming the Nasdaq Composite and S&P 500 indexes. Nonetheless, I see the corporate as a compelling funding alternative, and I believe shares are filth low cost.

Scrutiny at Salesforce

Since 2018, Salesforce has spent practically $50 billion to purchase three firms: MuleSoft, Tableau, and Slack.

To place this into perspective, Salesforce has generated solely about $35.7 billion in income over the past 12 months. Contemplating that the three firms talked about above have been a part of the Salesforce ecosystem for a number of years now, it is cheap to conclude that the corporate is probably not monetizing these property in addition to it might.

Furthermore, on condition that synthetic intelligence (AI) is the bedrock of the tech realm proper now, buyers look like uninspired by Salesforce’s paltry 11% income progress for its most up-to-date fiscal quarter, which ended April 30.

On the floor, I would say these considerations are legitimate. Nonetheless, a deeper dive into the corporate’s newest earnings report sheds gentle on the place Salesforce is witnessing spectacular progress, and extra importantly, how the working efficiencies administration has been pursuing are lastly starting to materialize.

Trying past income

Though the headline numbers on an earnings assertion are helpful for getting a way of an organization’s gross sales and profitability profiles, getting too caught up in these metrics alone could cause buyers to overlook the larger image.

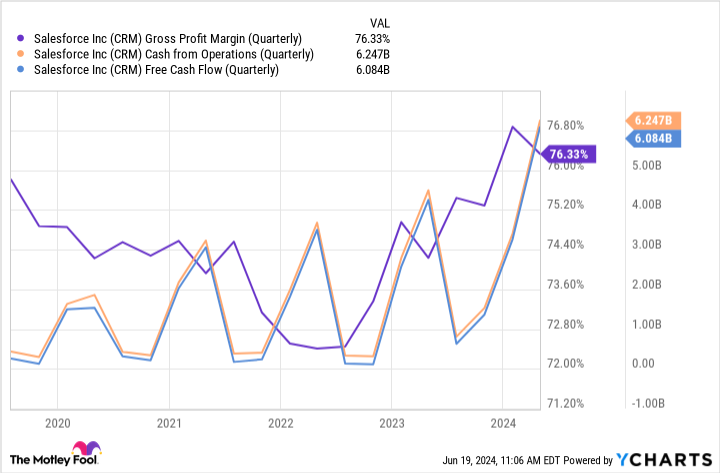

The chart beneath options another monetary indicators that I would encourage buyers to investigate.

There are a few vital themes to debate right here. First, Salesforce’s gross margin profile has improved dramatically over the previous couple of years. So too has its money circulation scenario.

This dynamic could be very a lot by design. “Now we have greater than tripled the money we generated simply 4 years in the past,” Chief Monetary Officer Amy Weaver stated through the firm’s most up-to-date earnings name. In essence, though Salesforce is barely rising income by 11% yearly, its free money circulation is rising by greater than 40% yearly.

To me, that sturdy progress in money circulation technology is much extra vital than tendencies within the high line.

Salesforce inventory is a cut price amongst AI software program alternatives

The chart beneath benchmarks Salesforce towards a cohort of different main enterprise AI software program companies on a price-to-free-cash-flow (P/FCF) foundation.

Amongst these friends, Salesforce has the bottom P/FCF a number of — and it is not even shut. I believe buyers are lacking the forest for the timber in the case of Salesforce and its potential as a number one AI alternative.

It is vital to needless to say income goes to ebb and circulation from quarter to quarter. Moreover, on a macroeconomic degree, the previous couple of years featured first a pointy spike in inflation after which, even after it retreated, the lingering impacts of that surge. Contemplating that, it is pure that companies of all sizes have reined in spending and are working below tighter budgets — a dynamic that can instantly impression Salesforce’s means to extend its revenues.

Furthermore, I would be remiss to not observe that the corporate’s integration and analytics enterprise — which incorporates Tableau and MuleSoft — was Salesforce’s top-performing operation through the first quarter, rising 25% 12 months over 12 months.

I believe Wall Avenue was appropriate to begin demanding extra progress from Salesforce’s acquired property. However because the AI narrative continues to unfold, I believe the corporate is merely scratching the floor of its potential.

As Tableau, MuleSoft, and different providers start to comprise a extra significant share of Salesforce’s general enterprise, I believe accelerating income prospects are very a lot in retailer. These ought to contribute much more to the corporate’s bettering revenue margin and money circulation positions.

I believe investing in Salesforce is a no brainer proper now. With the inventory buying and selling at such a noticeable low cost to its friends and underperforming the broader market, I believe Salesforce seems filth low cost.

Must you make investments $1,000 in Salesforce proper now?

Before you purchase inventory in Salesforce, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Salesforce wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet and Microsoft. The Motley Idiot has positions in and recommends Alphabet, Microsoft, Oracle, Salesforce, ServiceNow, and Snowflake. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

1 Ridiculously Low cost Synthetic Intelligence (AI) Development Inventory to Purchase Hand Over Fist Proper Now was initially revealed by The Motley Idiot