Some of the carefully adopted traders on Wall Road is Invoice Ackman, CEO of Pershing Sq. Capital Administration. Whereas Ackman’s portfolio has billions of {dollars} of funding capital, the hedge fund supervisor holds solely seven particular person shares.

Amongst this small cohort is only one expertise firm: “Magnificent Seven” member Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Earlier this month, Jason Helfstein of Oppenheimer raised his worth goal on Alphabet inventory to $185 — implying roughly 17% to present buying and selling ranges as of market shut on April 22.

Let’s dig into why Ackman and others on Wall Road have robust convictions on Alphabet and assess whether or not now is an efficient alternative to scoop up some shares.

Promoting is the money cow, however…

Alphabet’s core income and revenue drivers come from promoting. Contemplating the corporate owns web search web site Google and video-sharing platform YouTube, it is protected to say that Alphabet has an infinite presence on-line.

The desk under illustrates the expansion developments in Alphabet’s advert enterprise over the past a number of years.

|

Class |

2023 |

2022 |

2021 |

|---|---|---|---|

|

Google Search & different |

8% |

9% |

43% |

|

YouTube advertisements |

8% |

1% |

46% |

|

Google Community |

(4%) |

3% |

37% |

|

Complete Google promoting |

6% |

7% |

43% |

Knowledge supply: Alphabet investor relations

In recent times, Alphabet has been compelled to fight a variety of rivals encroaching on its advert enterprise. Meta Platforms owns a number of social media purposes, together with Fb, Instagram, and WhatsApp. Furthermore, the rising reputation of TikTok has additionally taken a toll on Alphabet’s attraction to advertisers.

However, even within the face of decelerating progress in its largest enterprise, Alphabet stays extremely worthwhile. It is this dynamic that I believe traders are miscalculating.

Certain, the promoting section is witnessing an existential disaster. Nonetheless, Alphabet’s sturdy working margins are flowing right down to the underside line. And the corporate is making some savvy investments in new progress drivers which can be already paying off.

…synthetic intelligence (AI) is the brand new progress driver

Along with promoting, Alphabet has a companies enterprise and a cloud computing operation. The Companies section consists of subscriptions to YouTube TV and NFL Sunday Ticket, purchases from the corporate’s app retailer, and gross sales from units, such because the Google Pixel telephone.

Buyers ought to be eager to know that the Companies enterprise is very worthwhile — producing $95.6 billion of working earnings in 2023, up 16% yr over yr. Furthermore, the cloud division is now persistently worthwhile. Final yr, Alphabet’s cloud section reported $1.7 billion in working revenue in comparison with a lack of $1.9 billion in 2022.

One of many major causes Alphabet has been capable of generate constant, sturdy profitability metrics throughout so many alternative areas of its enterprise is due to AI.

In his 2023 shareholder letter, Ackman outlined that Alphabet’s “aggressive positioning in AI overshadowed the high-quality nature of its enterprise and robust progress prospects.” It is a good means of alluding to some traders seeing higher alternatives than Alphabet concerning AI.

Nonetheless, the developments explored above undermine Ackman’s place with regards to Alphabet’s enterprise mannequin. As the corporate continues to combine AI all through its ecosystem, traders ought to start to see an exponential bounce within the firm’s income and revenue margin profiles throughout the numerous completely different areas by which Alphabet operates.

Is now an excellent time to put money into Alphabet?

As of the time of this text, Alphabet’s price-to-earnings (P/E) ratio of 26.9 is the second-lowest among the many Magnificent Seven — narrowly above Apple.

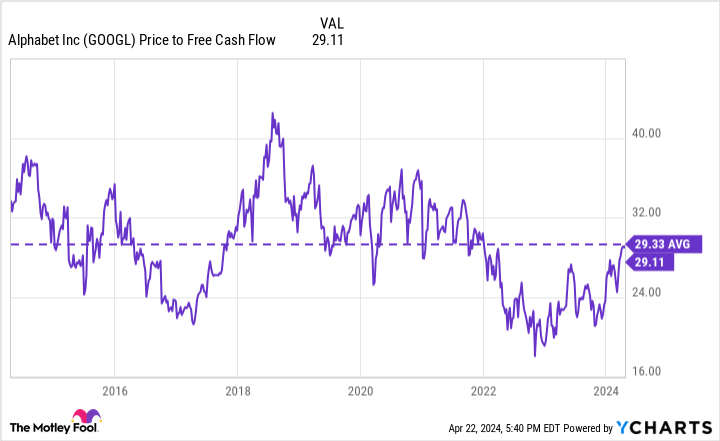

Furthermore, the corporate’s price-to-free money move is basically an identical to Alphabet’s 10-year common. Contemplating how a lot Alphabet has grown over the past decade and the way completely different the corporate is right this moment in comparison with 10 years in the past, I believe traders could also be steeply discounting future progress alternatives.

I believe now’s a profitable probability to purchase Alphabet on an underrated AI narrative. The inventory seems to be filth low cost relative to its friends, and with a lot potential upside, it is arduous to go on this one.

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Alphabet wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $537,557!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 22, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Apple, and Meta Platforms. The Motley Idiot has positions in and recommends Alphabet, Apple, and Meta Platforms. The Motley Idiot has a disclosure coverage.

A As soon as-in-a-Technology Funding Alternative: 1 Invoice Ackman Synthetic Intelligence (AI) Inventory to Purchase Hand Over Fist Earlier than It Surges 17%, In accordance with 1 Wall Road Analyst was initially revealed by The Motley Idiot